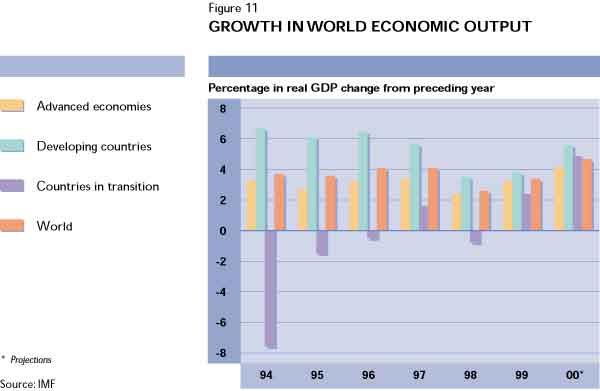

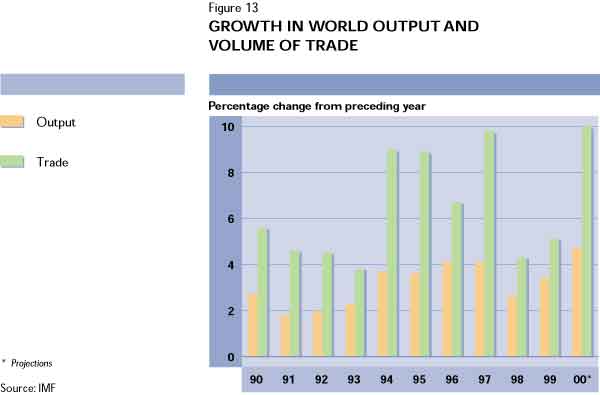

During 2000 there was a further strengthening of the economic recovery that had already manifested itself in 1999, after the global slowdown caused by the financial crisis in Asia in 1997 and 1998. World GDP was expected to grow by 4.7 percent, reflecting stronger economic activity in most regions of the world.5 Despite the higher economic growth, inflation rates edged up only modestly in response to higher energy prices. Growth in the volume of world trade, which had slowed to 4.3 percent in 1998 and increased to only 5.1 percent in 1999, is also expected to have gained strength to a rate of about 10 percent in 2000. The steep increase in oil prices influenced economic performance worldwide, although the shock was absorbed relatively well at the global and regional levels. However, net oil importers faced significant increases in their import bills which, for the poorest of them, translated into pressure to reduce other imports, domestic consumption and investment.

The advanced economies6 are estimated to have grown by 4.2 percent in 2000, up from 3.2 percent in 1999. A major factor underlying the improved performance for these economies was continuing growth in the United States (at an estimated rate of 5.2 percent), supported primarily by sustained labour productivity gains. Growth also gained strength in the EC (reaching an estimated 3.4 percent), as several major countries entered a cyclical upturn from the second half of 1999. The euro area made significant progress in reducing unemployment, which fell below 10 percent for the first time since 1993. Some recovery appeared to be taking hold also in Japan, with GDP growth projected to rise to 1.4 percent, mainly reflecting a rebound in business investment and a slow recovery in consumption demand.

In spite of the improved economic situation, prospects for the short and medium term in the advanced economies are uncertain. Persisting macroeconomic imbalances within and among the major economies present potential risks. These include uneven patterns of growth and demand and imbalances in intercountry payments, in particular strong trade and current account deficits in the United States and surpluses in Japan. The ability of the United States to reduce growth to sustainable levels in an orderly manner will be particularly important.

Indeed, in early 2001, concerns about the world economy were increasing as world economic growth appeared to be weakening following a slowdown in the United States economy and a waning of the recovery in Japan. The International Monetary Fund (IMF) announced an expected downward revision of its forecasts of world economic growth for 2001, initially projected to be 4.2 percent.

The transition economies have continued to exhibit major intercountry differences in reform and macroeconomic achievement. Being more advanced in the transition process, countries in Central and Eastern Europe and the Baltic states have shown better performances in output growth and inflation rates than the CIS (for a further discussion, see relevant section in Part 2, Regional review).

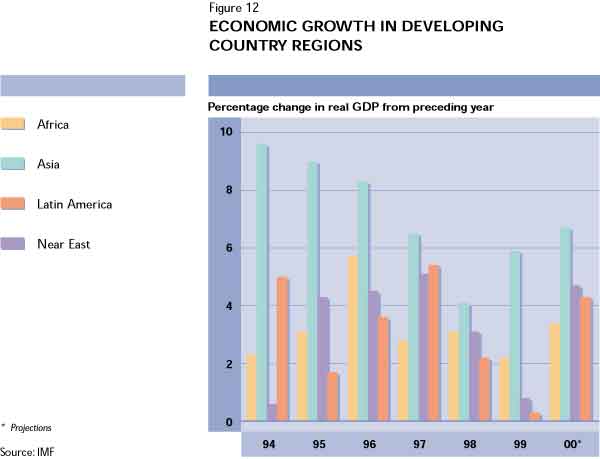

The developing countries are also estimated to have accelerated their economic growth, from 3.8 percent in 1999 to 5.6 percent in 2000. All developing country groups shared in this improved economic outlook. Indeed, current expectations are for a consolidation of economic recovery in most of the crisis-affected countries in Asia and a rebound after the previous year's slowdown in Latin America and the Caribbean, Africa and the Near East. However, the improvement in 2000 was uneven among regions and countries. In Africa in particular, per capita incomes were expected to grow by only 1 percent, after having fallen in 1999 and expanded only marginally in the previous two years.

Beyond region-specific factors, which are examined in more detail in the Regional review, the overall economic improvement experienced in 2000 largely reflected more favourable developments in the international economic and financial scene. The developing countries benefited in particular from the strengthening of economic activity in the advanced economies, which are their main sources of trade and financing. On the other hand, many developing countries were hit hard by the weakness of most non-oil commodity prices during the past three years, as reviewed in the following section.

Table 1

PRIMARY COMMODITY PRICE INDICES

IN US DOLLAR TERMS1

Year/ quarter |

Non-fuel primary commodities |

Petroleum | ||||

All |

Food |

Beverages |

Agricultural |

Metals |

||

1995 |

118.1 |

113.6 |

151.1 |

131.3 |

100.2 |

74.8 |

1996 |

116.7 |

127.5 |

124.9 |

127.7 |

88.2 |

88.6 |

1997 |

113.0 |

114.0 |

165.5 |

119.0 |

91.5 |

83.9 |

1998 |

96.4 |

99.7 |

140.3 |

99.5 |

76.6 |

56.9 |

1999 |

89.6 |

84.1 |

110.5 |

101.8 |

75.5 |

78.3 |

20002 |

91.0 |

83.7 |

92.2 |

103.1 |

84.6 |

122.8 |

2000 Q1 |

93.7 |

84.5 |

102.8 |

106.1 |

87.4 |

115.6 |

2000 Q2 |

92.0 |

84.1 |

95.5 |

106.5 |

82.7 |

116.7 |

2000 Q3 |

89.3 |

80.2 |

88.6 |

101.2 |

85.6 |

129.7 |

2000 Q42 |

89.1 |

86.0 |

81.8 |

98.4 |

82.8 |

129.2 |

1 1990 = 100. | ||||||

Following the financial crises in Asia, Brazil and the Russian Federation, agricultural commodity prices weakened markedly from 1997, and only gave weak signs of stabilization or, in some cases, recovery in the course of 2000.

The decline affected food and non-food agricultural commodities alike. After having increased by a cumulative 20 percent during the "commodity boom" years, 1995 and 1996, prices of food products fell sharply in 1997, 1998 and 1999 before stabilizing somewhat in 2000. Price trends were also extremely unfavourable for tropical beverages - except for in 1997 when temporary short supplies led to strong price increases - as well as for raw material prices which, however, strengthened moderately in 1999. Beyond commodity-specific factors (reviewed in Current agricultural situation - facts and figures 2), the persisting weakness of commodity prices was generally related to the inability of production to adjust to the slump in demand in 1998-99. Such downward adjustment is naturally slow to occur for crops such as tropical beverages and sugar cane. In the case of non-perennials, such as cereals and oilseeds, prices were under downward pressure in the late 1990s, following improved weather conditions and larger harvests and stocks, especially in North America. Some firming of commodity prices is expected in the short term, but it is unlikely that they will regain the levels of 1995-97.

The value of world trade in the principal primary agricultural commodities fell sharply in 1999 for the second year in a row, dropping by 6 percent to $203.7 billion as a result of both low commodity prices and flat trade volumes (Table 2). Estimates for 2000 indicate a substantial slowdown in the decline, largely owing to a notable increase in growth in the global economy which stimulated demand for some commodities. Nevertheless, international prices of many agricultural commodities remained near or below the depressed levels of 1999. This conferred substantial benefits on consumers, especially in importing countries, but caused economic difficulties for farmers in the producing countries.

Table 2

VALUE OF GLOBAL EXPORTS OF MAJOR AGRICULTURAL PRODUCTS

1998 |

1999 |

2000 |

1998-1999 |

1999-2000 | |

(Billion $) |

(Percentage change) | ||||

Beverage crops |

18.0 |

12.4 |

11.2 |

-31.1 |

-9.7 |

Cocoa |

2.8 |

2.2 |

1.7 |

-21.4 |

-22.7 |

Coffee |

11.0 |

7.4 |

6.6 |

-32.7 |

-10.8 |

Tea |

2.9 |

2.8 |

2.9 |

-3.4 |

3.6 |

Sugar |

10.2 |

7.6 |

9.2 |

-25.5 |

21.1 |

Bananas |

3.5 |

3.4 |

3.0 |

-2.9 |

-11.8 |

Citrus |

5.0 |

4.9 |

4.0 |

-2.0 |

-18.4 |

Cereals |

39.9 |

36.0 |

35.8 |

-9.8 |

-0.6 |

Meat |

41.0 |

47.5 |

48.9 |

15.9 |

2.9 |

Milk and milk products |

26.7 |

24.6 |

25.2 |

-7.9 |

2.4 |

Oils, oilseeds and meals |

54.9 |

51.8 |

46.9 |

-5.6 |

-9.5 |

Agricultural raw materials |

17.5 |

15.5 |

17.5 |

-11.4 |

12.9 |

Cotton |

8.3 |

7.5 |

8.9 |

-9.6 |

18.7 |

Jute |

0.6 |

0.4 |

0.4 |

-33.0 |

0.0 |

Hard fibres |

0.4 |

0.3 |

0.3 |

-25.0 |

0.0 |

Natural rubber |

3.6 |

3.0 |

3.4 |

-16.7 |

13.3 |

Hides and skins |

4.6 |

4.3 |

4.5 |

-6.5 |

4.7 |

TOTAL OF THE ABOVE |

216.7 |

203.7 |

201.7 |

-6.0 |

-1.0 |

Source: FAOSTAT (trade data for 1998). Data for 1999 and 2000 are preliminary, based on FAO estimates of trade volumes and market prices. | |||||

Medium-term projections for agricultural output and trade have been prepared for FAO by the Project LINK. The projections are produced in conjunction with Project LINK's global macroeconomic projections. The specific projections have a time horizon of 2000-2004. They were prepared in November 2000 and are consistent with the macroeconomic projections elaborated after the Project meeting in October 2000. It should be noted that the projections have not taken full account of the latest setback in the United States economy, which was faster than expected, or the serious slump in the Japanese economy, which became more evident in 2001. Agricultural GDP projections for the developing country regions are presented in Table 3.

Table 3

PROJECTED ANNUAL GROWTH OF AGRICULTURAL GDP

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

Average 2001-04 | |

(Percentage) | |||||||

Developing countries |

3.3 |

4.4 |

4.0 |

4.4 |

4.7 |

4.7 |

4.5 |

Latin America and the Caribbean |

0.4 |

3.9 |

4.1 |

4.9 |

4.5 |

4.5 |

4.5 |

Sub-Saharan Africa |

3.2 |

4.7 |

3.8 |

5.0 |

5.6 |

5.6 |

5.0 |

Near East and North Africa |

4.1 |

5.4 |

6.1 |

5.2 |

5.8 |

5.4 |

5.6 |

Asia and the Pacific |

4.3 |

3.8 |

3.5 |

3.5 |

3.3 |

3.7 |

3.5 |

China |

1.2 |

1.9 |

1.6 |

0.9 |

0.4 |

1.9 |

1.2 |

India |

8.1 |

3.3 |

3.3 |

3.7 |

3.7 |

2.9 |

4.3 |

Others |

4.7 |

6.1 |

5.3 |

5.6 |

5.6 |

5.7 |

5.6 |

Source: Project LINK. | |||||||

Against a background of projected good global macroeconomic growth, the projections suggest relatively strong growth also for the agricultural GDP of the developing countries as a whole. Throughout the projection period, annual agricultural GDP growth is expected to be in the range of 4 to 5 percent, strengthening towards the end of the period. At this rate, agricultural GDP in the developing countries would nevertheless grow less strongly than overall GDP for the developing countries, which is projected to grow at a rate of 5 to 6 percent throughout most of the period.

Agricultural trade of the developing countries is projected to expand relatively briskly throughout 2001-2004, with agricultural exports growing at an annual rate of about 6.6 percent over the period. The export expansion would be slightly stronger in Asia and the Pacific (7.5 percent - with 8.4 percent for China) and sub-Saharan Africa (7.4 percent), and slightly lower in the Near East and North Africa (6.3 percent) and Latin America and the Caribbean (5.3 percent).

Agricultural imports would, however, expand even more rapidly, at an average annual rate of 8.1 percent. Imports would grow strongly in Asia and the Pacific (9.5 percent - with 10.5 percent for India) and Latin America and the Caribbean (8.9 percent), but more slowly in sub-Saharan Africa (5.2 percent) and the Near East and North Africa (5 percent).

Only small changes are projected by Project LINK for the terms of trade of agricultural exports. After a deterioration of 3 percent in 2000, overall agricultural barter terms of trade would improve on average by less than 1 percent per year over the period 2001-2004 for the developing countries

as a whole.

There are two groups of countries for which agricultural trade is particularly important, and they are therefore especially sensitive to changes in the international economic and agricultural environment.

The country groups are: i) economies highly dependent on agricultural exports; and ii) low-income food-deficit countries (LIFDCs) with the lowest capacity to finance food imports. The economic and agricultural situation of these countries and their future prospects have particular relevance in the current context of weak prices of the commodities on which they largely depend, either as importers or exporters. The two groups, which are not mutually exclusive, have been more specifically defined as follows:

Exporters. This group includes developing countries for which exports of agricultural, fishery and forestry products are equivalent to at least 20 percent of their total exports or

20 percent of their total imports. It comprises a total of 53 countries (27 in sub-Saharan Africa, five in Asia and the Pacific, 20 in Latin America and the Caribbean and one in the Near East and North Africa).7

Importers. This group is a subgroup of the FAO's LIFDC category. There are three criteria that determine the classification of a country as low-income and food-deficit: i) a per capita GNP below the ceiling used by the World Bank to determine eligibility for IDA assistance and for 20-year IBRD terms; ii) the net food trade position of a country averaged over three years (volume-based and aggregated by calorie content); and iii) a criterion of self-exclusion at the request of the country. The subgroup of LIFDCs with the lowest capacity to import food, i.e. importers, comprises those countries for which food imports represent 25 percent or more of total export earnings and thus constitute a particularly heavy economic burden. The group comprises 37 countries (19 in sub-Saharan Africa, five in Latin America and the Caribbean, six in Asia and the Pacific and seven in the Near East and North Africa).8

For these two groups of countries, in addition to the medium-term projections elaborated by Project LINK, IMF has provided short-term macroeconomic forecasts (for 2000 and 2001) that are consistent with those contained in the October 2000 issue of World Economic Outlook.

For the group of exporters in 2000-2001, IMF projections indicate:

Prospects for the medium term suggest stronger agricultural sector growth in these countries. Indeed, according to Project LINK projections:

For the group of exporters, short-term prospects also point to an improvement compared with recent years. According to IMF forecasts for 2000 and 2001:

Medium-term prospects for these countries appear mixed. Project LINK forecasts to the year 2004 indicate that: