Forests – and their sustainable management – can play important roles in the transformation to a bioeconomy by producing renewable materials and ecosystem services while enhancing biodiversity and supporting livelihoods and income creation. Wood will likely play a key role.

The 2022 edition of SOFO featured an analysis of the potential future role of wood in the bioeconomy. Since then, the United States Department of Agriculture (USDA) has generated new projections of world roundwood and forest product demand using the Forest Resource Outlook Model (FOROM). The projections are made for four scenarios of global climatic warming and economic growth – (1) lower warming, moderate growth; (2) high warming, low growth; (3) high warming, moderate growth; and (4) high warming, high growth – based on the Intergovernmental Panel on Climate Change’s four “shared socioeconomic pathways” scenarios,54 which assume differing climate policies.

Figure 5 shows global roundwood demand according to the USDA projections and trend projections (as estimated for this report – see the note in Figure 5) to 2030 and 2050.55 The trend projections assume that future roundwood demand changes are in line with trends estimated from data for the period 2012–2022 and can be considered a business-as-usual scenario.

Figure 5Projections for global roundwood demand for 2030 and 2050

SOURCES: The trend projections were estimated for this report by L. Hetemäki, University of Helsinki, based on data for the period 2012–2022; data for the USDA (2023) projections were obtained from Johnston, C.M.T., Guo, J. & Prestemon, J.P. 2023. RPA forest products market data for U.S. RPA Regions and the world, 2015–2070, historical (1990–2015), and projected (2020–2070) using the Forest Resource Outlook Model (FOROM), 2nd Edition. In: Forest Service Research Data Archive. https://doi.org/10.2737/RDS-2022-0073-2

According to the projections, world roundwood production will increase by 4–8 percent between 2022 and 2030, depending on the scenario; thus, growth is expected to be moderate in the near future. Production could increase by 6–32 percent between 2022 and 2050 (with uncertainty increasing markedly over the longer period). In terms of roundwood volume, the projected increase to 2050 ranges between 240 million m3 and 1 200 million m3, depending on the scenario.

It should be noted that the projections in Figure 5 draw on data describing existing markets. Thus, they do not incorporate new products or future demand for products that may be in the early stages of development. Moreover, the main drivers used in the USDA estimates based on FOROM are economic growth and population growth; the model does not explicitly include (for example) the substitution of forest products and fossil-based products as a driver. Other model limitations include lags in incorporating new data and the aggregation of some product categories (e.g. engineered wood products, biofuels and chemicals).

FAO has made additional estimates to include potential impacts of three emerging forest products considered the most promising wood products for the large-scale substitution of non-renewable materials: (1) mass timber/cross-laminated timber (CLT) for construction;o (2) artificial cellulosic fibres from dissolving woodpulp, mainly used in the textiles industry; and (3) woodfuel for bioenergy.56 Demand for these products is estimated to increase roundwood consumption by up to 272 million m³ per year by 2050 compared with 2020, amounting to a total increase (baseline + new products) in global roundwood consumption (production) of approximately 49 percent over the period. Note that this projection focuses on demand for wood products. Multiple pathways that combine increased harvesting and processing efficiency, recycling, and planting of forests and trees, including in agroforestry systems and building on restoration efforts, can lead to sustainable wood supply in volumes to meet the increase in demand, supporting the bioeconomy.57

In line with traditional forest-sector outlook studies, the discussion above focuses on volume-based projections for forest products and roundwood. For national economies and forest-sector incomes, however, the value of these products may be more relevant than their volumes (Box 4).

Box 4Value-adding to increase the economic benefits of forests

According to a recent analysis,58 the European Union accounts for only 3.9 percent of the world’s total forest area but for 43 percent of global forest product exports by value (at USD 127 billion in 2022).17 In contrast, Africa has almost 16 percent of the world forest area but produces less than 2 percent of the value of world forest product exports. This is because Africa uses around 90 percent of the wood harvested as fuel for heating and cooking, and most of its wood exports are unprocessed (i.e. roundwood). Thus, not only does Africa retain less than 10 percent of the value of its timber, its industry creates fewer than 10 percent of the jobs it could generate if a greater share of finished and semi-finished products were produced and exported.59

Some countries in Africa are moving to add value to their wood exports. For example, Gabon has banned log exports since 2010 with the aim of encouraging greater in-country wood processing; subsequently, sawnwood production increased almost fourfold between 2009 and 2022 (from 2.8 million m3 to 10.3 million m3) and roundwood exports fell to almost zero (from 1.7 million m3 in 2009 to 0.01 million m3 in 2022). The Government of Gabon has put in place a range of other policy measures to develop the country’s forest sector.60

Woodfuel demand likely to decrease

The projections summarized in Figure 5 suggest that woodfuel consumption will increase modestly or decline slightly, depending on which of five future scenarios for economic and population growth are considered. A synthesis of modelling simulations by FAO showed a range of consumption estimates, depending primarily on underlying assumptions about traditional use of woodfuel in developing economies and the future role of wood in the global energy supply.56 In this synthesis, the estimated global consumption of woodfuel from forests in 2050 varied between 2.3 billion m3 and 2.7 billion m3, an increase of 17 percent and 37 percent, respectively, compared with consumption in 2022. Several major trends will shape future woodfuel consumption, including population growth, especially in Africa and South Asia; the expansion of alternative forms of energy, such as solar and wind; the uptake of more efficient technologies, such as modern cooking stoves; and policies that restrict or encourage woodfuel use.

Industrial roundwood demand likely to increase

Some trends, such as a shift towards a bioeconomy and the development of new products, are likely to increase roundwood demand to 2050 and beyond. Demand for some existing products, such as packaging papers, sawnwood and plywood, is also expected to increase; conversely, production of some traditionally important wood products is declining (e.g. newsprint, printing and writing papers due to a shift towards digital communication), thus reducing industrial roundwood demand for these purposes. For example, an estimate made for this reportp suggests that the continued decline of graphics paper production in line with current trends would reduce roundwood demand for that purpose by 133 million m3 by 2030.

Wood-use efficiency

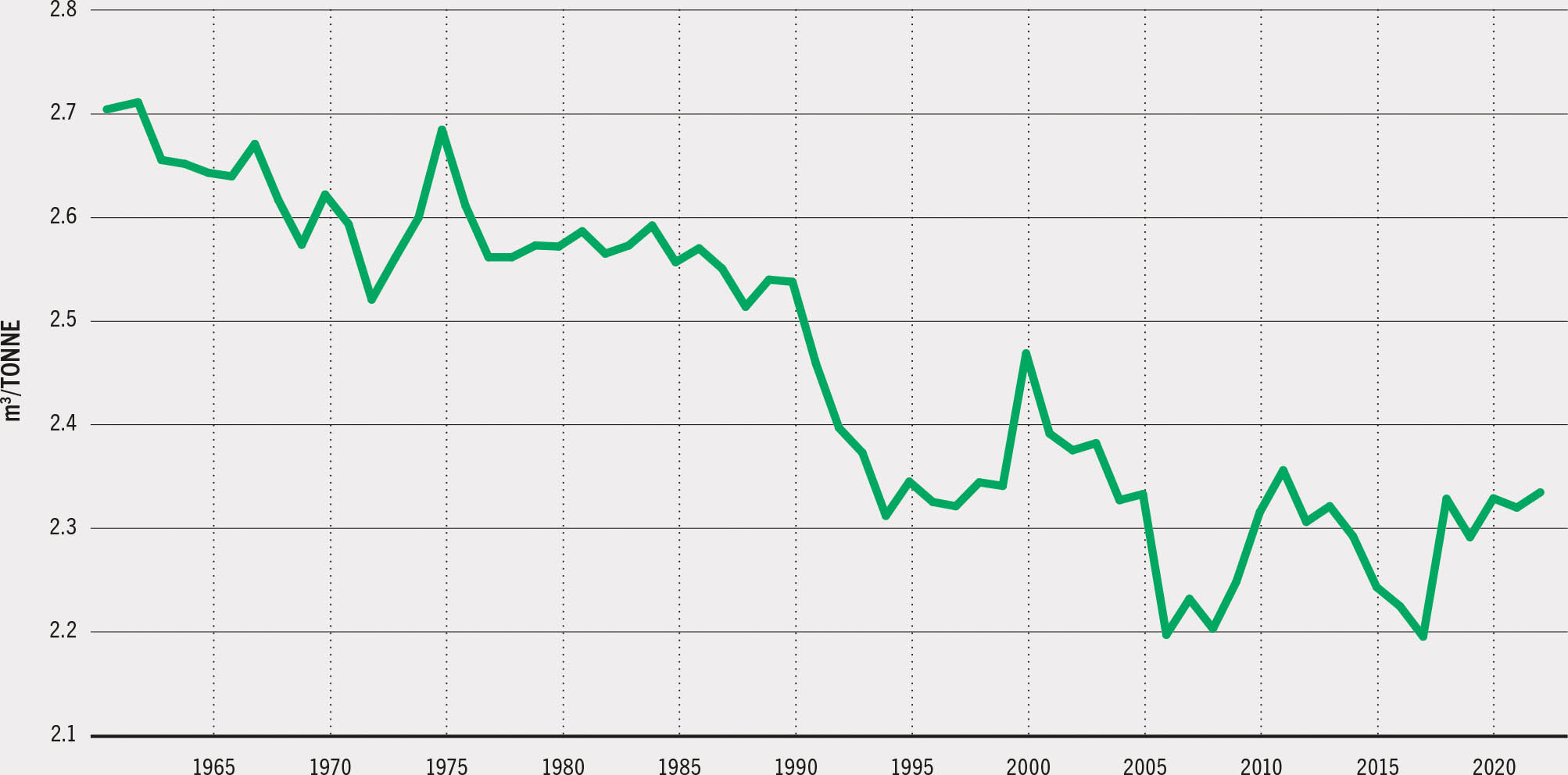

Figure 6 shows that the volume of industrial roundwood required to produce a unit volume of finished sawnwood, wood panels and paper and paperboard declined by about 15 percent between 1961 and 2022,q including about 5.7 percent since 2000; in other words, 15 percent more finished product could be produced in 2022 compared with 1961 for the same volume of roundwood. If this trend of increasing efficiency continues for the next couple of decades, it will be possible to produce the same volume of product as today in 2040 using 116 million m3 less industrial roundwood.

Figure 6Resource-use efficiency for industrial roundwood, 1961–2022

Uncertainties in future wood supply

The future supply of roundwood is prone to uncertainties, such as those arising from policy interventions, economic incentives, the development of planted forests and, more recently, climate-change-related forest disturbances. The higher concentration of carbon dioxide in the atmosphere and higher temperatures associated with climate change could increase the net growth of forests where sufficient water and nitrogen are available. Conversely, climate change is likely to lead to increases in the frequency, intensity, spatial extent and duration of disturbances such as those caused by wildfires, pests, storms and drought,62 potentially causing significant losses of harvestable biomass. Moreover, climate change could cause long-term shifts in harvest volumes in boreal forests from softwood to hardwood.63,64

The impacts of climate change will depend to a significant degree on the extent to which countries are able to increase the resilience of their forests to the changing climate. This, in turn, will depend partly on the policy decisions taken to mitigate and adapt to climate change and to stop biodiversity loss; for example, policies on forest carbon, biodiversity and other aspects could restrict timber production, with some scenarios indicating decreasing wood volumes if non-wood benefits are prioritized.56

Another factor in the future roundwood supply is the forest area available for production (both planted and naturally regenerated). In 2020, naturally regenerated temperate and boreal forests provided about 44 percent of global industrial roundwood production, with planted forests supplying another 46 percent.56 Agroforestry and rubberwood plantations also produce industrial roundwood (possibly accounting for the remaining 10 percent),56 although this has not been analysed systematically.41 The area and growing stock of naturally regenerated temperate and boreal forests are expected to increase, suggesting the possibility of increasing timber production in them (subject to the uncertainties described above).65 Some studies estimate that the area of forest plantations could increase by 20 million–40 million ha by 2050 as another means for meeting increased wood demand,66 although their production capacity would depend on a wide range of factors, such as time since establishment, climatic regime, the species used and the management practices applied.