Climate finance has a complex architecture to direct financial flows towards climate-change mitigation and adaptation activities, including through results-oriented mechanisms such as carbon markets and REDD+. The UNFCCC COP 26 has further elevated the importance of climate in the global agenda. There, countries and the private sector made financing pledges of nearly USD 20 billion and have agreed on new rules governing carbon markets, which are expected to grow significantly and have considerable potential to support the pathways (Box 24).

Box 24The crucial role of forests acknowledged at the 2021 UN Conference on Climate Change

The Glasgow Climate Pact is an outcome of negotiations at the 26th Conference of the Parties (COP 26) to the UN Framework Convention on Climate Change, held in Glasgow, Scotland, in late 2021. The pact calls for a doubling of adaptation finance by 2025 and for developed Parties to meet a commitment of USD 100 billion annually by 2025.

In the context of negotiations on Article 6 of the Paris Agreement (carbon markets), countries agreed to set rules to strengthen the integrity of carbon markets (covered under Article 6.2, Article 6.4 and Article 6.8) and create a new global carbon-offsetting mechanism (including forestry). Progress was made on several aspects at COP 26, including that 5 percent of the proceeds from collected offsets will be redirected towards the Adaptation Fund for developing countries.

In the Glasgow Leaders’ Declaration on Forests and Land Use, also announced at COP 26, the leaders of more than 140 countries, accounting for more than 90 percent of the world’s forests, committed to work together to halt and reverse forest loss and land degradation by 2030. The pledge was backed by USD 12 billion in public funding (the “Global Forest Finance Pledge”) and USD 7.2 billion in private funding. More than 30 financial institutions (with more than USD 8.7 trillion in global assets) committed to eliminating investments in activities linked to agricultural-commodity-driven deforestation.

SOURCE: Anonymous. 2021. Glasgow Leaders’ Declaration on Forests and Land Use. In: UN Climate Change Conference UK 2021 [online]. [Cited 2 February 2022]. https://ukcop26.org/glasgow-leaders-declaration-on-forests-and-land-use/

The sale of carbon offsets improves the financial attractiveness of the three forest pathways. Carbon markets are expected to continue growing

Many forestry projects improve their financial attractiveness and justify larger investments by selling carbon offsets. These can be earned in various forest-related projects, such as tree-planting, improved forest management with reduced-impact logging, and avoided deforestation. Carbon credits are issued into registries after third-party verification to assess additionality, baseline setting, emissions monitoring, leakage and permanence. The impact on the ground of such projects varies hugely, depending on the type of project. Carbon credits constitute a funding source for projects that could not be implemented otherwise and therefore have the potential to generate manifold benefits. Various funds are being set up to take advantage of this financing opportunity (Box 25).

Box 25Funds for sequestering carbon through forestry

The aim of the Restore Fund is to invest in forestry projects that will remove carbon from the atmosphere while generating financial returns for investors. Launched in early 2021 by Apple, with Conservation International and Goldman Sachs, the USD 200 million fund aims to sequester at least 1 million tonnes of carbon dioxide equivalent annually. In 2020, the International Civil Aviation Organization included forestry among eligible options for airline offsetting.396 In 2021, a public–private consortium launched a call for proposals to purchase up to USD 1 billion in carbon credits for forestry activities.397

Demand for carbon credits originates in a range of carbon markets, broadly grouped as voluntary markets (often related to the voluntary offsetting targets of firms) and compliance markets (based on regulations that oblige firms to reduce emissions).

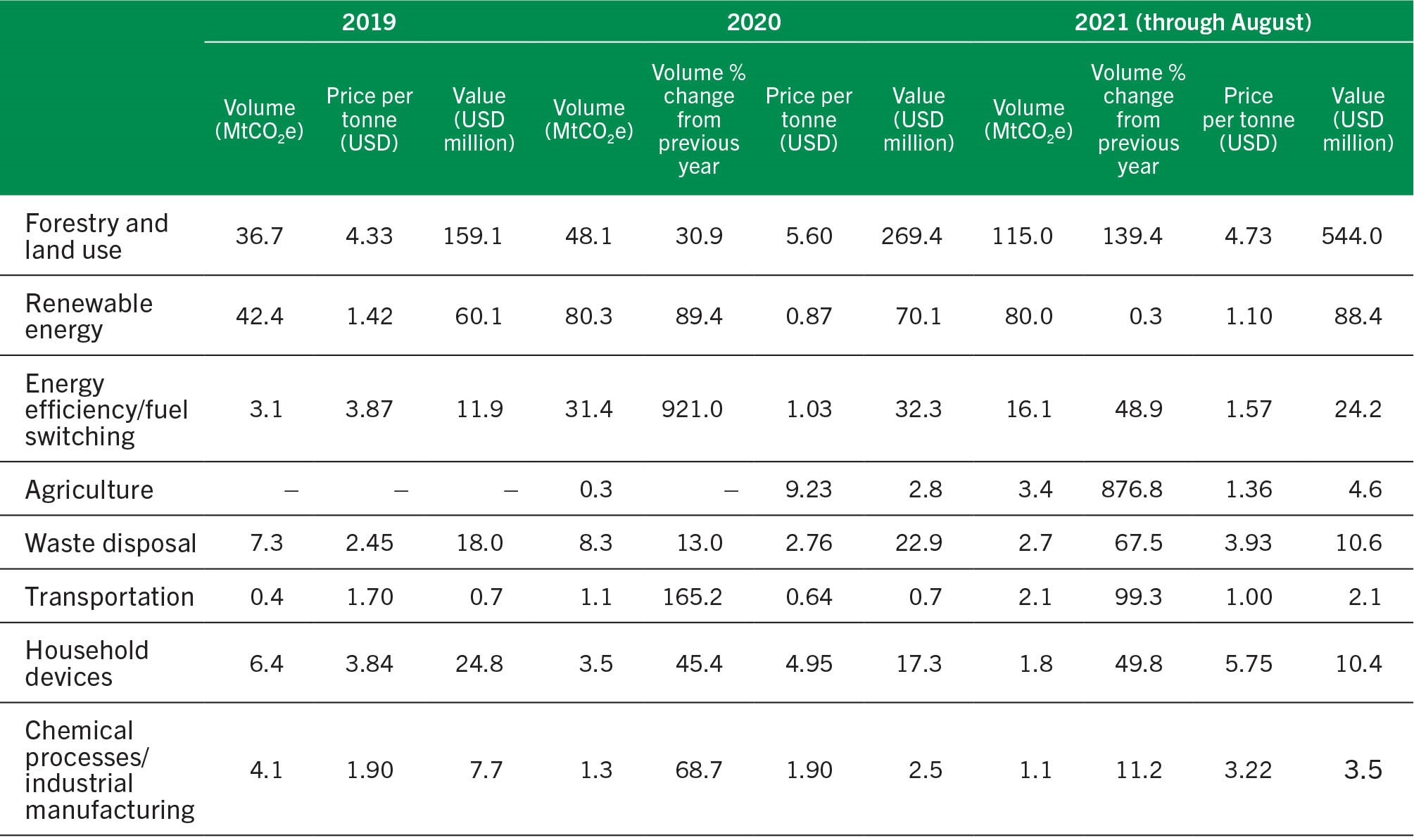

The global voluntary offset markets generated nearly USD 400 million in 2017–2019 through 105 million (MtCO2e) forestry carbon credits.398 This market continues to expand, with transactions (as of August 2021) exceeding USD 0.5 billion (Table 6). Compliance markets, although still small, far exceed the value of voluntary markets: for example, the California–Quebec emissions trading system (ETS) issued 83 million forestry carbon credits valued at USD 1.2 billion in 2017–2019, and the New Zealand ETS issued 38 million forestry carbon credits with a value close to USD 800 million.399 Other compliance markets generating significant demand for forestry carbon credits include Australia’s Emissions Reduction Fund, Colombia’s carbon tax and the Republic of Korea’s ETS. Demand in carbon markets is modest at a global scale (although it could be significant nationally and subnationally, such as in Colombia, New Zealand and California). Much of the attention on carbon markets is in expectation of future growth – although this is uncertain. Even if forest offset markets grow in volume and pricing, the extent to which they would offer opportunities for investment in the forest pathways is unclear.

Table 6Voluntary carbon market size by project category, 2019–31 August 2021

The recent agreement at UNFCCC COP 26 on detailed rules for carbon-credit transfers between countries supports expectations of future carbon market growth. Using the Paris Agreement’s Article 6, governments can now use carbon credits (referred to as internationally transferred mitigation outcomes, or ITMOs, in Article 6) to meet their mitigation commitments. A process for both the public and private sectors to generate ITMOs will be developed in coming years, which is expected to also cover nature-based solutions. Countries can use the newly available framework to offset part of their mitigation commitments, which could create significant additional demand for carbon credits. There was much contention in the UNFCCC negotiations on the merits of offsetting, however, and restrictions were introduced on ITMO exports (through a need for “corresponding adjustments” – that is, to deduct exported volumes from own performance against targets). More clarity is needed on the interest of countries in using Article 6 before the scale of additional demand and supply can be gauged.

A key step for obtaining access to carbon markets for projects and programmes is working towards compliance with the requirements of a given carbon standard and registering in its transaction registry. Large forestry firms – whether in plantations or natural forests – find accessing carbon markets challenging; small and medium-sized enterprises and small farmers require specialized help to gain access to such markets, which might come from project developers able to aggregate hundreds and even thousands of smallholders to constitute a sizeable project area.

Result-based payments for REDD+ are evolving to ensure they deliver climate-change mitigation results with environmental integrity and adequate benefit-sharing

REDD+ was originally conceived and structured around the novel concept of RBPs: that is, payments made on the achievement and independent verification of a pre-agreed set of carbon emissions reduction results over a given time frame, as per UNFCCC guidelines, or the achievement of a predefined set of results related to, for example, progress made in the readiness or implementation of policies and measures for addressing drivers of deforestation and forest degradation. Mozambique recently received USD 6.8 million from the Forest Carbon Partnership Facility for reducing 1.28 million tonnes of carbon emissions since 2019.

Of all disbursements estimated by the largest results-based climate finance funds,m the forest and land-use sectors have been by far the main recipient.400 RBPs continue to evolve as climate finance funds and their donors assess the efficacy and efficiency of this instrument. Attention is now being directed towards the delivery of results with sufficient environmental integrity (e.g. with proper accounting frameworks) and benefit-sharing mechanisms (Box 26). The forest finance portfolios in the Green Climate Fund and the Global Environment Facility continue to evolve. For example, the Green Climate Fund project portfolio on forests and land use currently (December 2021) stands at 52 projects and USD 1.5 billion.401

Box 26Results-based payments in the Green Climate Fund

The Green Climate Fund (GCF) has made results-based payments (RBPs) to countries that reported emission reductions to the UN Framework Convention on Climate Change. As of November 2020, the GCF had approved a total financial volume of USD 497 million in eight countries that had demonstrated results and met the requirements for receiving RBPs under the GCF REDD+ pilot programme. An analysis of options for the programme’s next phase identified two key themes: equity in access; and ensuring sufficient environmental integrity. RBPs can help strengthen policy coherence if disbursements to recipient countries are made on the achievement of pre-agreed policy milestones and the proceeds are reinvested in activities in line with the country’s nationally determined contributions, its REDD+ strategies, and its low-carbon development plans.

Markets for carbon-neutral and sustainable products require credible monitoring, reporting and verification systems – and these are improving

Systems for monitoring, reporting and verifying the efficacy of investments and interventions to reduce deforestation and degradation and to produce carbon-neutral and sustainably produced products must be sufficiently robust to assure donors and companies that results have sufficient environmental integrity. Nesha et al. (2021)402 assessed the use and quality of forest data for national reporting to the FRA in 236 countries and territories. They found that, globally, the number of countries monitoring forest area at good to very good capacities increased from 55 in FRA 2005 to 99 in FRA 2020 when using remote sensing and from 48 to 102 when using national forest inventories.403 Overall, MRV capacity improvements are most widespread in the tropics, which can be linked to international investments for forest monitoring associated with REDD+.404 Chagas et al. (2020) assessed several carbon standards, focusing on additionality, baseline setting, the quantification of emission reductions (particularly uncertainty), permanence and leakage; they concluded that forest carbon credits may be considered a reasonable option for corporate offsetting provided stringent rules are in place to provide sufficient assurance that such credits come with the environmental integrity equivalent to those generated in other sectors.405