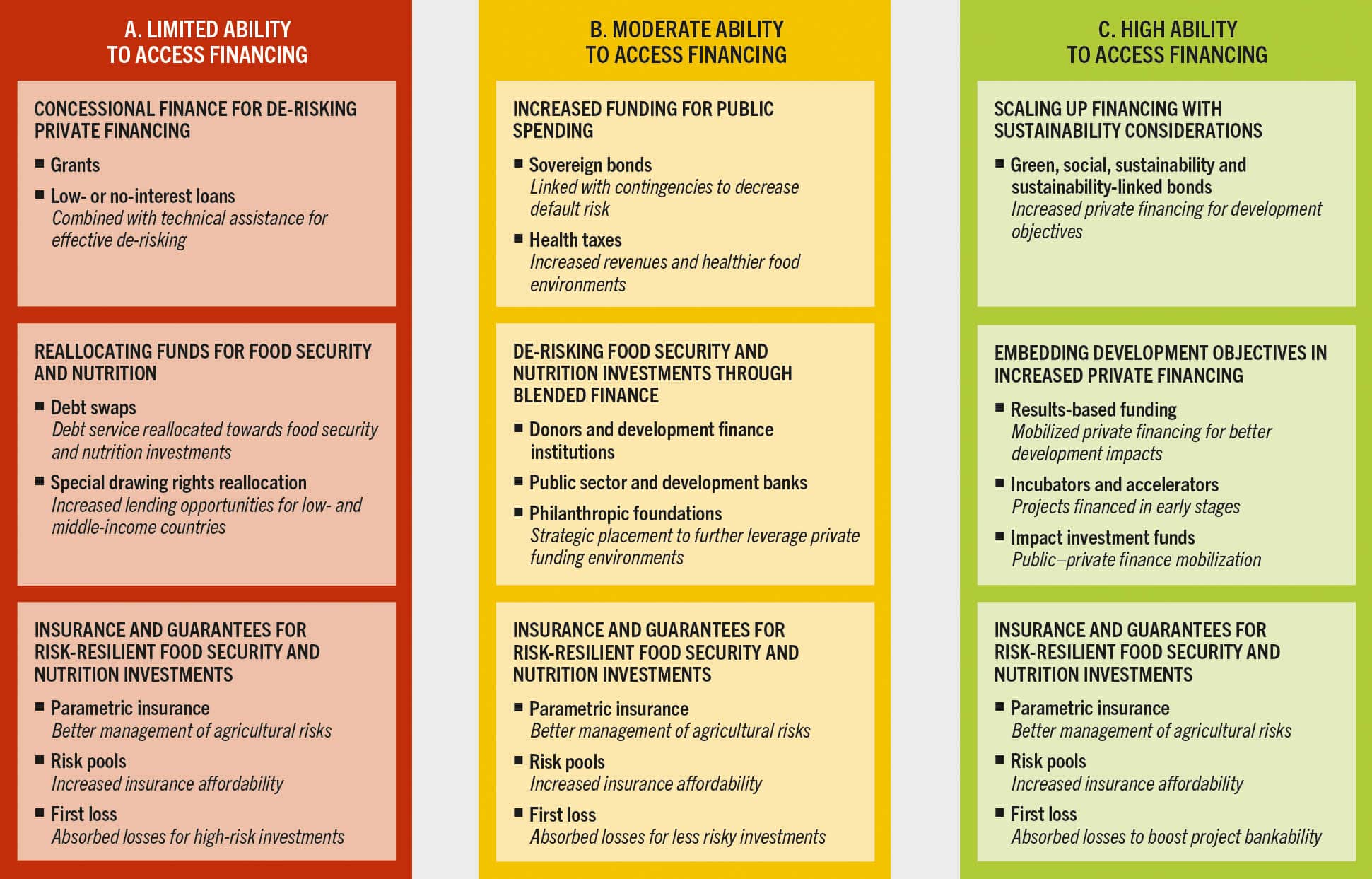

The adoption of innovative financing instruments will be essential for scaling up food security and nutrition financing flows to meet SDG Targets 2.1 and 2.2. Of course, as mentioned previously, it is critical that countries also consider repurposing their current public spending to make it more cost effective (Chapter 4), as well as implementing reforms to enhance their macroeconomic performance and governance quality. In any case, considering that eradicating hunger, food insecurity and malnutrition requires not only strategic medium- and long-term actions, but also immediate answers, this section focuses on the financing instruments currently available to countries. While the first part of this section analyses in detail the most promising instruments considering the country’s ability to access financing (see Figure 31), the second part discusses how financial inclusion can be strengthened within countries, focusing on the population segments that face more constraints in accessing financial services. These financing instruments should, from a food security and nutrition perspective, provide the necessary resources to implement the policies and investments recommended in the six transformative pathways presented in Chapter 3. The examples of investments financed through these financing instruments, provided in this section, are linked with elements of the food security and nutrition financing definition, when relevant.

Instruments for scaling up financing at global, regional and national levels

Available financing tools for increasing food security and nutrition financing flows are described below, following the categories of a country’s ability to access financing presented in Section 5.1. This section covers the tools mainly used for mobilizing financing flows at the sovereign level (for country governments), as well as tools for private actors within countries, from companies to smallholder farmers, as they are all crucial for ending hunger, food insecurity and malnutrition. Among these tools, emphasis is placed on the type of financing instruments that promise innovative approaches to fill the financing for food security and nutrition gap. Yet, why is innovation needed and how can it mend the gap that traditional mechanisms cannot?

Innovations, particularly market-creating innovations,32 provide a strong economic foundation since they offer the mass population access to a product or service that was previously unaffordable, unattainable or non-existent. In the case of financing, innovation mobilizes, leverages and redirects resources to increase the effectiveness and efficiency of financing flows, directing them to specific purposes33 such as food security and nutrition that they would otherwise not be directed or channelled to. That said, although all instruments and mechanisms are at countries’ disposal – depending on their risk profile and thereby the cost of capital – the optimal financing options for achieving food security and improving nutrition are not easily accessible for countries with high levels of financial risk.

The term “innovative finance” became more widely used during the 2000s, amidst concern about the resources required to meet the Millennium Development Goals. It is difficult to agree on a universal definition, considering the different beliefs regarding what constitutes “innovation”. For this report, an innovative financing instrument for food security and nutrition is one that fulfils at least one of the following conditions:34

- It has been developed in the last ten years.

- It is implemented in a different way from its original purpose.

- It is new to being used in financing for food security and nutrition.

- It involves new combinations of actors.

Financing instruments for countries with limited ability to access financing flows

As mentioned in Section 5.1, the high perception of risk from private stakeholders for this country group, and the often limited capacity of increasing public domestic revenues, makes concessional finance from international development flows the most suitable option for scaling up financing for these countries.

While grants and low- or no-interest loans are certainly among the most traditional concessional financing instruments, they can be designed in more innovative ways to collaborate with de-risking initiatives to increase private financing flows, as part of blended finance strategies. As the amount from grants and other concessional financing instruments falls short of the funding needed to meet SDG Targets 2.1 and 2.2, these instruments should focus on countries most in need and invest in activities that are not likely to be financed by other instruments, for example, public goods.35 Grants and/or loans, jointly implemented with technical assistance, can be leveraged to address the main limitations for accessing private financing flows – for example, poor bankability and lack of operational readiness to access finance – often faced by food security and nutrition initiatives (Figure 33A). For instance, the Good Food Innovation Fund uses both grants and interest-free loans to support initial investments in midstream small and medium enterprises (SMEs) producing nutritious foods (e.g. biofortified foods, dairy and aquatic food products), with the objective of increasing the SMEs’ ability to access other sources of financing after that first investment (Pathway 4).36 The injection of grants can likewise support initiatives to pioneer high-tech solutions to enhance food security and nutrition by protecting and regenerating traditional and/or indigenous crops, which often in time strengthen climate resilience and improve nutrition within their territories: Rockefeller Foundation grants are financing the Vision for the Adapted Crops and Soils initiative, a project focused on identifying and promoting the production of crops with the greatest potential to improve nutrition in Africa (Pathway 4). In the first phase, a research institution analyses the indigenous and traditional crops’ productivity under different climate scenarios, while in the second phase, a private company steps in to leverage artificial intelligence to analyse current barriers and potential facilitators for scaling up these crops.37

FIGURE 33 Recommended innovative financing instruments for countries, considering their ability to access financing flows

SOURCE: Authors' (FAO) own elaboration.

Grants can also be implemented alongside loans for countries facing high climate variability, such as hilly landlocked or small island countries. In Nepal, the Adaptation for Smallholders in Hilly Areas project totalled USD 37.6 million, funded by a grant, a government contribution and participants’ contributions. The project contributed to strengthening the capacity of vulnerable smallholder farmers and local institutions to adapt to climate-related risks (Pathway 2). Impact assessment findings show that the project improved production capacity – for example, by increasing access to irrigation especially during the dry season by 4 percentage points – and increased livestock sales by 112 percent.38 In Kiribati, the Outer Islands Food and Water Project, aimed at improving the livelihoods and resilience of people living in nine of the country’s poorest islands, was financed with a grant complemented by government investments. The project enhanced beneficiaries’ nutrition and health by improving water management through installation of rainwater harvesting for households, promoting home gardening and the consumption of underutilized species, and providing training and farming tools (food availability). Between inception and completion, results indicated a 41 percent reduction in severe food insecurity and increases in dietary diversity.39

The term debt swaps (or, more precisely, debt-for-development swaps) refers to a conditional restructuring of a specific part of debt, which in most cases is linked to some form of debt relief. The condition requires that the liberated funds (or a portion of them) are redirected towards a predefined development investment. Especially at times when many LICs and MICs – home to the most food-insecure people – are highly indebted, debt swaps provide debtor countries with fiscal space, whereby the cancelled amount is repurposed domestically and typically earmarked for sustainable projects (Figure 33A).

The most common form of debt-for-development swaps are bilateral public debt swaps, directly negotiated between a creditor and the debtor country. The creditor foregoes all or part of the principal and/or interest due; in exchange, the debtor country commits a set amount (in local currency, when possible) towards a development project agreed upon by the two parties. Payment in local currency by the debtor country reduces the country’s external debt obligations in foreign-denominated currency, freeing up scarce foreign currency reserves. The type of sustainable investment differs among debt-for-development swaps and may include investments in education, health, food security and nutrition.

Debt-for-nature or debt-for-climate swaps exchange debt in return for environmental or climate investments. Recent debt-for-climate swaps have attracted a great deal of attention due to transactions involving substantial volumes of debt and amounts of money. Their design differs significantly from the design of the traditional debt-for-development swap discussed above. Debt-for-climate and debt-for-food security swaps are explained in more detail in Box 12.

BOX 12Debt swaps for climate and food security and nutrition objectives

Since 2000, global debt levels have surged fourfold.40 Many of the countries grappling with debt problems are also among the most vulnerable to climate change.41 Countries facing this double challenge are caught in a vicious cycle. Climate-related destruction and disasters necessitate substantial investments, but their fiscal space is constrained as a significant portion of resources must be allocated to debt servicing.42 The debt servicing obligations of 58 of the low- and middle-income countries (LICs and MICs) most vulnerable to climate change are projected to reach nearly USD 500 billion between 2023 and 2026.42

For countries struggling with both unsustainable public debt and high levels of food insecurity and/or malnutrition among their population, the situation is similarly dire. Substantial debt servicing obligations impede the ability of governments to invest in crucial food security and nutrition policies. They reduce foreign exchange reserves otherwise available for food imports and hamper investments in health, nutrition and education, critical for enhancing future human capital and laying the foundation for sustainable pathways out of food insecurity and malnutrition. The analysis in Section 5.1 underscores the large number of countries struggling with this double challenge: Out of 119 LICs and MICs, 75 have limited or moderate access to any financing flow (see Table 18).

In the three decades up to 2017, debt swaps have alleviated governmental liabilities amounting to USD 2.6 billion in exchange for investments in development or climate action totalling USD 1.2 billion.41 The bulk of these transactions comprise modest-sized bilateral, directly negotiated between debtor and creditor countries.41 To date, creditors have been Paris Club countries.* Recent years have witnessed heightened attention towards debt-for-climate swaps. Current transactions, such as those in Belize, Ecuador and Gabon, have individually reached volumes of USD 1.6 billion, USD 553 million and USD 500 million, respectively.43–45 In 2023, China, the largest bilateral creditor for LICs and MICs, signed a first memorandum of understanding with Egypt to negotiate a debt swap for development projects.46, 47 Although still considered a niche financial instrument, debt-for-climate swaps hold immense potential, with an estimated market size of USD 800 billion.42, 48

These recent debt-for-climate swaps – so-called tripartite swaps – involve development partners as financial intermediaries providing loans to debtor countries for the repurchase of debt. The loans are contingent upon the recipient country’s commitment to introduce and implement nature or climate policy measures. Financing for these loans typically involves labelled bonds (see details on green bonds in this chapter), bolstered by support from donors or guarantees from multilateral banks, enabling favourable credit terms including beyond market interest rates and maturities.41 This approach allows both bilateral swapping and swapping of privately held debt. It further broadens refinancing options and offers a lifeline to countries excluded from credit markets.

Given the critical challenges posed by unsustainable debt burdens and high levels of food insecurity and malnutrition in many countries, exchanging debt for food emerges as a practical solution with good potential. Debt-for-food security swaps have already been instrumental in addressing food insecurity and malnutrition. Noteworthy initiatives, such as home-grown school feeding and social protection programmes, have been supported. In the current situation, where some countries’ food import volumes have fallen, leveraging freed-up foreign exchange through debt relief to procure essential foodstuffs on international markets presents a viable option.

To date, debt-for-food security swaps have been used primarily to swap bilateral debt.41 In practice, they are typically executed through development partners to ensure effective implementation, transparency, mutual accountability and thorough monitoring and evaluation. Successful examples led by the World Food Programme (WFP) in countries such as Egypt, Guinea-Bissau, Madagascar, Mauritania, Mozambique and Pakistan demonstrate the effectiveness of this approach. Notably, resources totalling USD 145 million since 2007 were allocated to existing WFP programmes within these countries. For instance, a debt swap signed by Egypt and Italy in 2009 channelled approximately USD 15 million worth of Egyptian debt towards a school feeding project implemented by WFP, significantly improving nutritional outcomes and educational participation.49

Special drawing rights (SDRs) are an international reserve asset created by the IMF that can supplement countries’ foreign exchange reserves in case of need.51 Special drawing rights have the potential to alleviate cost escalation and exchange rate losses resulting from diminished foreign currency reserves by bolstering foreign reserves, thereby assisting in currency stabilization. Acting as part of IMF members’ foreign exchange reserves, SDRs can be sold – or exchanged freely as usable currency – to other countries and prescribed holders who are allowed to acquire, hold and use SDRs. Therefore, the use of SDRs can reduce inflationary pressure on capital expenditure and on working capital finance for businesses.34 There were four SDR allocations, the last one in 2021, in response to the COVID-19 pandemic. Special drawing rights are allocated proportionally to the relative size of a country’s economy, which means that most allocations go to HICs. Considering that HICs have a wide fiscal space compared to the limited access to financing flows of many LICs and MICs, SDR reallocation towards the latter country groups can provide an adequate window of new resources for development finance,52 which can be used to fill the financing gap to end hunger, food insecurity and malnutrition (Figure 33A). Such reallocation can be channelled through multilateral development banks (MDBs); for example, the African Development Bank (AfDB) and Inter-American Development Bank (IDB) have already signed agreements to that effect. This channelling could allow SDR financing to then be leveraged for food security and nutrition and other development purposes. An alternative is to continue using the resources from SDRs in the IMF’s Resilience and Sustainability Trust (RST)an and the Poverty Reduction and Growth Trust (PRGT).ao, 54

The G20 pledged to reallocate about USD 100 billion worth of SDRs sitting unused in HICs’ central banks to LICs and MICs at the end of October 2021 (20 percent of each G20 country’s reserves). However, the actual pledges are still nearly USD 13 billion short, and less than 1 percent of support has been received by countries in the direst economic straits. Australia, Canada, China, France, Japan and Saudi Arabia have exceeded their 20 percent pledge, but many countries have either not engaged at all or are having difficulty reaching 10 percent.34

One potential utilization of the SDRs is for lending: An example is the hybrid capital model proposed by the AfDB and the IDB, both IMF prescribed holders. The initiative proposes to borrow rechannelled SDRs and leverage these static foreign reserves in HICs into lending instruments to finance transformational development projects. The African Development Bank would then channel the financing into regional entities such as the African Export–Import Bank and other regional development banks for capacity building, credit enhancement and beyond. With the current imbalanced holding of SDRs between the major holders and African and other developing nations, prescribed holders such as the multilateral banks are in a perfect position to garner the necessary resources for their respective regions as a whole.55

Insurance and guarantees are instruments to facilitate lending and financing, particularly to specific sectors and actors that might be considered “risky”.56 As indicated in Figure 31 and Figure 33, these instruments are relevant at all levels: for countries with limited access to financing and high financial risk perception, but also for other countries that have more options to access financing instruments. Of course, the cost of implementing these instruments may vary depending on the level of financial risk (being more expensive in contexts of higher risk). Box 13 analyses these instruments and provides relevant examples for all levels of access to financing.

BOX 13Insurance and guarantees, essential tools for de-risking food security and nutrition investments

Insurance is an essential tool for building resilience to risks in agrifood systems, enabling improved access to credit and financial services. Even so, insuring agrifood small and medium enterprises (SMEs) and smallholder farmers is still very challenging, and important public or donor subsidies are often needed to make insurance work for them.57 In fact, insurance coverage remains very low in low- and middle-income countries due to its high premium costs and the low awareness of its benefits among agrifood SMEs and smallholder farmers.58 For example, out of 600 million farmers in Africa, only 600 000 possess insurance coverage.59 Women, particularly in rural areas, face more challenges than men to access insurance products, due to their lack of resources and lower levels of financial literacy, the distrust of financial institutions, and discriminatory social norms and policies that may prevent them from signing legal contracts without male signatories. As a result, they tend to acquire lower value coverage.60

Innovative insurance tools include yield-index insurance, parametric/index-based weather insurance and trade credit insurance.61 Case studies from sub-Saharan Africa have shown that the adequate combination of de-risking instruments depending on the national and subnational context is key for maximizing their impact in rural contexts. In addition, it is important to include technical assistance components and implement them before engaging the beneficiaries with other rural finance instruments.62 In particular, parametric insurance is a valuable instrument for managing agricultural risks associated with weather-related events such as droughts, floods or extreme temperatures, contributing to reducing risks by offering a dependable income source in the face of weather-induced crop failures (Figure 33). Parametric insurance is typically used to complement traditional insurance. While conventional insurance refunds adjusted losses suffered by policyholders caused by an insured peril, up to the policy limit, parametric insurance pays out a specified sum when a certain, very specific event occurs – the “parameter”.

However, the implementation of parametric insurance can be financially burdensome, encompassing expenses associated with data collection, index development and administrative operations. These elevated costs often translate into higher premiums, impeding the affordability of insurance coverage. Moreover, parametric insurance may not comprehensively address all risks, for example, those stemming from pests, diseases or market fluctuations. Consequently, farmers remain exposed to losses outside the coverage scope of the insurance scheme.34 These challenges have been addressed in some countries using risk pools, which are groups of stakeholders that band together to share insurance resources and costs (Figure 33). For example, in 2023, the African Risk Capacity (ARC) Group, comprising two agencies* from the African Union, which provides insurance services through risk pooling, launched a new parametric insurance mechanism for African countries to cope with the devastating effects of flooding. This product provides countries with predictable and rapid financing for early response to cope with emergency disaster events caused by floods (Pathway 2). The flood product generates daily flood analysis and calculates the associated impacts for each country. These impacts are compared to the parametric triggers (economic losses or the number of people affected), and pay-outs are calculated if flood impacts exceed the trigger threshold defined by the country.63

There are also interesting examples of parametric insurance in countries with limited access to financing flows. Pula, an insurtech** company, together with the World Food Programme’s Rural Resilience Initiative (R4) in Kenya, allows farmers to access a combination of crop insurance and risk reduction practices which protect them from the impact of climatic shocks (Pathway 2).*** Specifically, the initiative invests in the Area Yield Insurance Index (AYII) in support of government efforts to offer microinsurance coverage to farmers. The AYII adopts ecological zones as a way of measuring unit areas for insurance compared to the previous administrative boundaries. This method reduces the risk basis and provides fairer compensation to farmers.64

In Rwanda, the Ministry of Agriculture and Animal Resources initiated the National Agriculture Insurance Scheme in collaboration with three insurance firms: SONARWA Life, Prime Insurance and RADIANT. The programme involved governmental subsidies covering 40 percent of the premiums for weather-indexed and yield-indexed insurance (Pathway 2). Consequently, it expanded the access of smallholder farmers and agrifood SMEs to pre-harvest financing. Additionally, the One Acre Fund, backed by concessional finance from donors, plays a significant role in advancing Rwanda’s agricultural insurance sector.58

Guarantees serve as cash collateral against loan defaults for lenders who are considered high risk. This instrument is particularly important within countries to close the financing gap for smallholder farmers and agrifood SMEs in LICs and MICs.65 However, guarantees have not proved very effective in terms of incentivizing domestic banks to expand their lending activities in agrifood systems, primarily due to inadequate expertise and the absence of tools for assessing sector-specific credit risks.58 For example, the ARIZ fund, launched by the French Development Agency and jointly operated by Alliance for a Green Revolution in Africa (AGRA) and Standard Bank, guarantee credit to fertilizer distributors in Africa. AGRA and partners provided a USD 10 million loan guarantee fund, and in turn, Standard Bank made USD 100 million available for loans over three years. Nevertheless, the programme did not perform well due either to low utilization or to financial institutions’ risk appetite vis-à-vis the guarantee amount.66 To overcome this challenge, scaling up results-based lending incentives for domestic banks is needed to incentivize them to increase their lending to smallholder farmers and agrifood SMEs.58

Finally, first loss is a guarantee instrument in which the investor is the first to take losses if the project or business fails (Figure 33).36 For instance, INVEST – a United States Agency for International Development mechanism supporting funding mobilization – provides first-loss coverage and directly influences the risk profile of a project by absorbing losses should the investment not perform as forecasted, thereby presenting a more attractive investment target.67

** The term “insurtech” refers to the use of technology to develop accessible insurance initiatives; it is part of “fintech”, financial technology applications oriented to improve the access of smallholder farmers and other agrifood actors to financial services.68

*** Interestingly, the cost of the premium is paid not in cash but upon fulfilling the condition of participating in asset-producing activities.57

Financing instruments for countries with moderate ability to access financing flows

Countries with moderate ability to access financing can start moving beyond the use of concessional finance towards other instruments. One alternative for governments is scaling up public resources. For example, income-linked sovereign bonds have gained attention since the onset of debt crisis situations such as the 2008–2009 financial crisis; they link the obligation to pay to countries with an indicator of the ability to pay, thus reducing the risk of defaults (Pathway 3). These bonds can create important welfare gains and allow national fiscal policies to be more stable and predictable.69 Pure income-linked bonds are related to GDP growth (e.g. the bonds issued by Argentina some years ago), while similar bonds – contingent bonds – can be related to export levels, commodity prices or the occurrence of natural disasters, among others (Figure 33B).70

Governments can also increase their tax revenue linking these with other development outcomes.ap One of the most interesting examples for enhancing health and nutrition is health taxes. These are excise taxes levied on products of high energy density and minimal nutritional value, such as sugar-sweetened beverages (SSBs) (Pathways 4 and 5). They are cost effective – but largely underusedaq – policies for creating incentives to reduce dietary risk factors for non-communicable diseases (NCDs) with untapped potential for the triple win of improving health, generating government revenue and enhancing equity (Figure 33B).72–74 By reducing the consumption of products with high energy density and minimal nutritional value, and creating incentives to substitute them with healthier options, health taxes can contribute to the prevention and control of overweight, obesity and other forms of malnutrition or dietary risks, reducing costs to the health care system.71, 75 Governments can also use health taxes as a tool to increase revenues for financing actions that can combat food insecurity and malnutrition in all its forms, either through specific spending prioritization or by increasing overall national budgets. While revenues obtained through health taxes tend to represent only a small fraction of GDP, the revenue increases from taxes can be significant, particularly when taxes across a range of harmful products are combined. In addition, health tax revenues tend to account for a significant share of public health expenditure, ranging from 15 percent in HICs to over 30 percent in LMICs.76 A recent World Bank analysis found that the largest financing gap for universal health coverage in LMICs could be largely mitigated by tax increases on SSBs, tobacco and alcohol.77 By releasing additional resources to be spent on food or improving food environments, such taxes can indirectly help reduce undernourishment and food insecurity.

Some countries have opted to earmark part or all of revenues generated from health taxes towards health promotion (Pathway 5). Of the nine countries that apply excise taxes to SSBs with revenues earmarked for specific purposes, most are destined for NCD prevention and treatment, health system financing and promotion of physical activity.71, 75 For instance, in Portugal, revenue generated by the specific excise tax on non-alcoholic beverages is destined for health care. Within one year of implementation, USD 90 million were generated, all of which contributed to funding the Portuguese national health service.75 Health taxes can also be used to shape agricultural practices. In the Philippines, for example, 15 percent of the revenue generated from taxing tobacco is earmarked to assist tobacco farmers in planting alternative crops. Similar approaches could be taken with SSB taxes, using revenues to support farmers in the transition from sugar production to other crops. It will be imperative for such schemes to ensure that the alternative crops are nutritious foods that contribute to a healthy diet. Ultimately, the decision to earmark funds depends on the contextual factors faced by individual countries. Opponents of this practice argue that it can increase rigidities in the budget and inefficiencies in spending, since earmarked funds cannot be easily diverted to other purposes, should new priorities arise. Some also argue that, although earmarking funds for health can diversify sources of public health funding, this does not necessarily lead to an increase in overall revenue for public health. This is because budgets are fungible, meaning that earmarked revenue from one source is likely to be offset by reductions in contributions from other sources of financing. An alternative is to implement a soft earmark, aligning more closely with the standard budgeting process. With this approach, the recommended earmark remains flexible – because no set amount is prescribed for the earmark, or the expenditure benefiting from the earmark is quite broad, or the duration is limited. By highlighting a political priority, soft earmarking can enhance the visibility and political acceptability of a health tax.76, 78, 79

As indicated in Section 5.1, countries with limited ability to access financing urgently need to de-risk financing flows, and this is possible through concessional finance. Nevertheless, even if countries with moderate ability to access financing have better chances of leveraging private financing flows, these flows still need to be de-risked. In both cases, implementing blended finance – a development finance strategy combining different types of sources of financing to attract private capital – is essential. It is a de-risking tool for private investors, increasing investment in agrifood systems transformation, and has been increasingly used at the global level to de-risk financing flows towards agrifood systems (Figure 33B). Blended finance is used when there is a high perception of risk among private investors, channelling financial resources that can take on more risk with a longer investment horizon.80 Especially when there is a substantial development benefit, actors such as governments and donors can use blended finance as a vehicle to channel the financing flows needed to achieve that outcome. The objective is that, over time, the risk perception will diminish due to the initial support of the more risk-tolerant capital, and that commercial finance can then replace the grants or concessional financing which played a crucial and catalytic role in the initial stage.81

Considering that agrifood investments are often considered high-risk, blended finance is particularly important for catalysing private investments to meet SDG Targets 2.1 and 2.2. Data show divergent evidence. For example, in 2022, 36 percent of global climate blended finance deals supported rural and smallholder farmers, marking a significant increase from 26 percent in the period from 2016 to 2018;61 overall (not counting only climate finance), nearly 25 percent of the total transactions between 2016 and 2018 were oriented towards agriculture.70 In contrast, another study identified that, by value, the blended finance transactions deployed across food value chainsar in the world represent just 6 percent of the total market value.82 Nevertheless, as indicated in Chapter 4, a modest amount of blended finance transactions were oriented to SDG 2 in the period from 2020 to 2022; therefore, there is ample room for increasing the importance of blended finance for ending hunger, food insecurity and malnutrition.

The Nutritious Foods Financing Facility (N3F) expects to be an example of how blended finance can support the attainment of SDG 2, taking into consideration the cost and affordability of healthy diets. Focused on sub-Saharan Africa, N3F’s objective is to mobilize financing flows into agrifood SMEs that process and produce safe and nutritious foods (Pathway 4). Its structure, comprising multiple capital tranches, is expected to attract a wide range of actors, from those with a high risk-taking and catalytic profile to short- and long-term investors. While many financing actors have a focus on climate, smallholder farmers or sustainable agriculture, focusing on midstream SMEs contributing to healthy diets and positive nutrition outcomes is quite new, and may be perceived as risky due to the complex landscape. The support of different public and private actors, including government donors (United States Agency for International Development) and philanthropic foundations (Rockefeller Foundation), in addition to the technical background of the Global Alliance for Improved Nutrition, has allowed N3F to reduce the perception of risk among private investors.36, 83

Another recent example of blended finance applied to food security and nutrition is the Africa and Middle East SAFE (Scale-up Agriculture and Food systems for Economic development) Initiative, launched at the end of 2023 at the Twenty-eighth Session of the Conference of the Parties to the United Nations Framework Convention on Climate Change (COP28) by the leading DFIs from Africa and the Near East. The objective of the initiative is to mobilize USD 10 billion to develop climate-smart agricultural investments that can contribute to food security and economic growth (Pathways 2 and 3). Contrasting with the above example, the initial investment opportunities identified are related to staple foods – rice in Senegal and wheat in Ethiopia – with the objective of increasing the domestic production of these crops and, therefore, reducing the import bill for staple foods.84

Nevertheless, an open question is the effectiveness of this financial approach. Evidence has shown that the leverage ratio (the additional amount of financing flows mobilized) of traditional blended finance instruments is lower than expected for LICs, where the total amount of blended finance instruments (particularly concessional debts and guarantees) of every US dollar from a DFI or national development bank has mobilized only an additional USD 0.37 from private commercial sources. On the other hand, LMICs show different results, mobilizing slightly more than the invested US dollar (a ratio of 1:1.06), while the leverage ratio falls again in UMICs to USD 1:0.65. These numbers may imply lowering the expectations regarding the amount of money that blended finance can mobilize.34, 85 In addition, the most recent data show that the overall volume of blended finance operations decreased by about 45 percent in 2022, reflecting the key macroeconomic and political challenges that the world – particularly LICs and MICs – is facing.86 However, it is important to consider blended finance results not only from a resource mobilization perspective but also in terms of other “additionalities” beyond resource mobilization,34 i.e. the achievement of an outcome that would not have been reached without the inflow of the financial resources, for example, the diversification of financial intermediaries.67

Multilateral Financial Institutions (MFIs) can play a lead role in enhancing blended finance’s mobilization of resources.as Nevertheless, playing that role would imply achieving a delicate balance: They should take a greater risk to unlock other commercial private flows, but not so great that these are crowded out.67, 87 One example is the Rural Kenya Financial Inclusion Facility Project, a USD 142.6 million project that aims to provide catalytic financing and technical assistance to support the financial inclusion of 190 000 rural Kenyan households. The project combines the capacity building of local commercial banks, MFIs and deposit-taking savings and credit cooperatives, alongside training for potential borrowers with a Rural Credit Guarantee Scheme and a Green Financing Facility. The project also works with local financial service providers to provide innovative green financing solutions specifically for youth (Pathway 6).88

In East Africa, the Africa Rural Climate Adaptation Finance Mechanism (ARCAFIM), led by financing institutions including Equity Bank and by Nordic countries, addresses the pressing need to strengthen support for East African small-scale food producers’ adaptation to climate change. By integrating blended finance and incentivizing private sector participation, ARCAFIM allocates a total of USD 180 million for climate change adaptation loans, complemented by USD 20 million for technical assistance. Leveraging the expertise and resources of private financial institutions like Equity Bank, ARCAFIM aims to pioneer climate change adaptation financing in the region, enhancing agricultural sustainability and resilience to climate shocks. Through this innovative financing mechanism, ARCAFIM aspires to alleviate poverty and hunger in rural communities by supporting agricultural livelihoods and fostering economic growth amidst climate uncertainty (Pathway 2).89

Financing instruments for countries with high ability to access financing flows

Green, social, sustainability and sustainability-linked (GSSS) bonds are debt instruments that can be issued by governments, multilateral development banks, commercial banks and local corporates; they are linked with development goals, and can be especially relevant for targeting financing for countries that are affected by some of the major drivers of food insecurity and malnutrition such as climate extremes and/or economic slowdowns (Figure 33C). The global issuance of GSSS bonds has grown markedly since 2012.90 Nevertheless, after reaching a peak in 2021, the amount of GSSS bonds issued saw a decrease in 2022, to then recover in 2023,at reaching a total amount of USD 981 billion.91 Among GSSS bonds, green bonds are those where proceeds go to financing climate and environmental projects and initiatives, and they are the main instrument used for sustainable climate finance. Green bonds are also predominant among all other kinds of GSSS bonds, representing 74 percent of the total amount of GSSS bonds issued by the private sector in 2023, while for the public sector these bonds are also the most prevalent, but to a lesser extent; for instance, in the period from 2021 to 2023, green bonds represented on average 45 percent of the total GSSS bonds issued.92 It should be noted that from 2012 to 2022, the issuance of GSSS bonds was largely dominated by HICs,au which accounted for 71 percent of the total issuance. However, when considering only green bonds, China has become the country that issues the majority of this kind of instrument.

In Latin America and the Caribbean, since at least the 2010s, several governments have enacted regulatory frameworks and policies to promote green finance tools, including green bonds, and as a result the issuing of green bonds has increased, in terms of both the number of countries and the value of the bonds.93 For example, in Mexico, Trust Funds for Rural Development, an agricultural development finance institution under the Bank of Mexico, issued three green bonds to a total value of USD 400 million (as at 2023) to finance sustainable agriculture projects, water efficiency investments, and renewable energy and energy efficiency projects (Pathway 2).94

One important incentive for issuing green bonds is that they show high returns relative to conventional emerging market bond indices.70 However, in some cases, the premium paid for these bonds might be larger than that for “regular” bonds for LICs and LMICs.95 In addition, there is the risk of green bonds being used for “greenwashing” of private companies,70 which means that even if companies use these instruments, they do not necessarily adopt more sustainable practices over time.96

Social and sustainability bonds do not represent a large portion of the GSSS bonds issued by the private sector, but they are relevant for the public sector, accounting on average for, respectively, 29 percent and 26 percent of all GSSS bonds between 2021 and 2023.92 On the other hand, sustainability-linked bonds have only been issued recently by the public sector and represent just 1 percent of the total issued in the triennium from 2021 to 2023,92 but their role may become more important in the coming years. For example, in 2023, the Development Bank of Rwanda (BRD) issued, for the first time, a sustainability-linked bond.av The bond is backed by an escrow financed by the World Bank through concessional finance and allows the BRD to mobilize financing flows to finance projects oriented to one of the three main objectives of the bond: i) improving environmental, social and governance (ESG) practices; ii) increasing access to financing for women-led projects; and iii) financing the building of affordable housing (Pathway 6). If borrowers meet certain performance indicators related to at least one of the three objectives, they are rewarded with lower interest repayments.97

While for the private sector, the use of the proceeds of the GSSS bonds issued is mostly oriented towards renewable energy projects, energy efficiency and green buildings, for the public sector the priority is largely social expenditure, followed by biodiversity conservation. Interestingly, the share of proceeds related to agriculture is very minor, representing only 1 percent of total public sector expenditure (and 0 percent of private sector expenditure).92

Multilateral Financial Institutions have also started to use bonds to raise funds from capital markets. For example, in 2022, two private placements were settled under IFAD’s Sustainable Development Finance Framework. These bonds are sold to investors with a strong ESG corporate profile who generally support transforming agriculture, rural economies and agrifood systems. The proceeds of the bonds are used to finance development projects through loans to borrowing countries. On such loans, borrowing countries pay a market-based rate that allows IFAD to pay a commensurate coupon to the investors. The first two private placements were bought by Folksam, a Swedish insurance and pension fund, for USD 100 million, and Dai-ichi Frontier Life, a provider of savings-type life and pension insurance, for USD 50 million.98

Results-based funding (RBF) consists of financial instruments linked to the achievement of certain results (Figure 33C). For example, impact bonds are outcome-based instruments that provide capital to an activity with specific and measurable outcomes. The repayment to the investor is linked to the achievement of these outcomes; in most cases, failure to reach the outcomes leads to a loss, while in some cases, the bond is designed to provide an additional payment when outcomes are reached.99–101 On the other hand, impact-linked finance describes all private financial activities that are linked with rewards for achieving positive social outcomes. These instruments have been used in both the health and the agrifood systems sector. For example, through the Global Partnership for Results-Based Approach project in Ghana, an RBF grant was used to stimulate demand for urban household sanitation, attracting larger contractors to supply toilets to low-income communities as well as financial institutions to enter the market.102 From an agrifood systems perspective, a project has been financed by the Impact-Linked Fund for Eastern and Southern Africa via an impact-linked loan to encourage the company to engage with more women farmers throughout the value chain, and as such, lower the interest rate of the loan (Pathway 6).36 Another example is Aceli Africa, a market incentive facility that offers results-based financial incentives to domestic lenders in Kenya, Rwanda, Uganda and the United Republic of Tanzania. Without these incentives, local lenders could refrain from providing loans to agrifood SMEs. Supported by donors, this facility provides various incentives, including origination incentives for domestic lenders to cover the cost of extending loans of between USD 25 000 and USD 500 000 to agrifood SMEs in remote areas or of supporting the production of local food crops (food availability); impact bonuses for loans extended to agrifood SMEs meeting higher standards in environmental and social performance, gender inclusion, food security and nutrition (Pathway 6); partial loan guarantees for loans between USD 25 000 and USD 1.75 million; and technical assistance to agrifood SMEs and capacity-building support to domestic lenders.58

Incubators and accelerators provide funds to projects that are in an early stage of development with the objective of consolidating them in the long term (Figure 33C). For example, in Cameroon, the Youth Agropastoral Entrepreneurship Promotion Programme provides comprehensive support to young entrepreneurs, including 100 percent subsidized education, blended financing, and coaching for business start-ups. The blended financial mechanism incorporates young entrepreneurs’ own capital, a start-up loan with no interest, and productive credit. A one-off subsidy from the project, in the form of a starter kit, facilitates the installation of young entrepreneurs and encourages the development of existing activities (Pathway 6). Impact assessment findings show that the project impact on food security is positive. About 59 percent of the beneficiaries have achieved minimum dietary diversity for women aged 15 to 49 years. The impact on gross annual income shows a 48 percent increase in total annual income. This represents an increase of approximately USD 1 500 in total gross household income per year. Youth enterprises supported by the project have an average profit margin of about USD 3 000 with an annual growth rate of 38 percent between 2016 and 2022.103

All countries must address the current failure of agrifood systems by investing domestic resources to address the major drivers of food insecurity and malnutrition. The creation of impact investment funds can support the mobilization of financing for this objective from a public–private perspective (Figure 33C). United Nations Trade and Development (UNCTAD) estimated that, by 2022, more than 7 000 sustainable funds existed, and they accounted for USD 2.5 trillion (a drop from USD 2.7 trillion in 2021). A large part (83 percent) of the global sustainable fund assets were managed by European countries, followed by the United States of America (12 percent) and China (2 percent).104

One other example, the Child Nutrition Fund (CNF) is a new financing instrument designed to transform the way the world addresses child wasting. The Match Window of the CNF offers national governments the opportunity to match domestic resources for essential services and supplies. Since its launch in 2021, the Match Window has supported over a dozen countries across Africa and Asia, including Cambodia, Ethiopia, Eswatini, Kenya, Mauritania, Nigeria, Pakistan, Papua New Guinea, Senegal, Sierra Leone, Timor-Leste, Uganda and Zambia. In 2023, the CNF’s Match Window deployed over USD 9 million in matched funding primarily for the procurement of ready-to-use therapeutic foods for the treatment of child wasting. The single largest recipient of this matched funding in 2023 was Pakistan (USD 5.9 million), followed by Ethiopia and Uganda, both receiving around USD 1 million in matched funding. In Pakistan, the CNF also concluded the first match for multiple micronutrient supplements for women, matching over USD 300 000 in domestic resources from Punjab Province. In 2024, the CNF Match Window is expected to match over USD 15 million and enter the first of a series of multi-year matching partnerships with national governments to increase government investments in nutrition to foster greater sustainability of nutrition financing.105

However, sometimes these funds, as well as many of the financing instruments discussed in this section, are not available due to the lack of technical capacity of enterprises that could be potential recipients of the investments. For example, this is often the case with agrifood SMEs in LICs and MICs.106 Yoking financing to activities to improve the recipients’ access to financial services can make a difference in turning the increased financing flows into impactful investments for food security and nutrition. If the population most in need does not receive adequate financing, not only will meeting SDG Targets 2.1 and 2.2 not be possible, but neither will achieving other objectives such as SDG 1 (No Poverty) and SDG 10 (Reduced Inequalities).

Increasing financial inclusion and equality within countries

Not only financing, but also financial inclusion is among the means of implementation to achieve all the SDGs.107 Even if financing for food security and nutrition could be scaled up using the innovative instruments described above, within countries there are population groups that have historically faced important constraints in accessing financial services. This section provides examples for some of the population groups; however, this does not exclude the recognition of several other segments in situations of vulnerability and marginalization, for which adequate policies are also necessary.

Women play a key role in agrifood systems, representing 37 percent of rural agricultural employees at global level and 48 percent in LICs.60 However, while 78 percent of men had access to a bank account of some kind in 2021, for women the figure was only 74 percent – a 4 percentage-point gap that, for LICs and MICs, increases to 6 percentage points (74 percent for men, 68 percent for women).108 The gap can be even wider at the country level, considering access not only to bank accounts but also to other financial services. For example, in India, while the account access gap was successfully closed between 2017 and 2021, there remains a 5 percentage-point gap in access to borrowing and a wider 13 percentage-point gap regarding the use of banking accounts for saving purposes.109 Increasing women’s access to financial services would not only contribute to women’s social and economic empowerment, but it would also improve the overall livelihoods of their households and communities, including food security and nutrition outcomes110 (Box 14). From a macro perspective, women’s inclusion would bring overall positive economic growth effects,111 which could increase the country’s resilience to economic slowdowns and downturns.

BOX 14Closing the gender gap in accessing financing flows and services

The structural constraints that women face to access financial services require the adoption of an inclusive and gender-transformative approach* that takes their different backgrounds and needs into account, as well as the differences between women themselves, related to age, ethnicity, health and disability status, among other social factors.109

A main underlying cause of gender inequalities is women’s common lack of the traditional collateral required to access credit, as they are less likely than men to own land, which makes them less attractive clients for formal financial institutions. For example, group-based approaches can enable asset-poor women to use social collateral instead of physical collateral for accessing credit. Commonly adopted by microfinance institutions, this approach allows women to use a group’s joint liability as collateral for accessing credit. Nevertheless, one of the limitations of this approach is that it usually provides short-term credits that do not allow women beneficiaries to make major investments.110, 114

Some countries have promoted the use of movable collateral such as jewellery or livestock units, in opposition to the usual request for fixed assets. For example, the establishment of public movable collateral registries can reduce the risks of using movable goods as collateral. For agricultural producers, warehouse receipt finance is an approach where the stored production is used as collateral for accessing credit and can be sold later when prices are more convenient.114

Microleasing is another promising approach in which collateral is not required since the microfinancing institution retains full ownership of the asset until the payment is completed, giving women the opportunity to purchase capital goods and, therefore, access other sources of financing. A microleasing approach can be more convenient than microcredit for women; for instance, since microleasing is linked to a specific capital good, women can trust that it will not be expropriated or used by other household members for non-business-related expenditures.114

Mobile money has had a positive impact on women’s financial inclusion, changing their financial behaviour and increasing their engagement in savings and budget planning, contributing to their economic empowerment.60

However, these measures should be implemented jointly with initiatives for tackling inequalities and gender norms that prevent women from participating in economic activities. This implies addressing the structural barriers to women’s empowerment and gender equality, by giving equal access to productive resources, services, local institutions and decent employment, supporting their engagement in planning and decision-making, and strengthening technical skills and financial literacy. It also requires overcoming discriminatory social norms and rules and changing financial behaviour within households and communities. Otherwise, the increased levels of access to financial services will not be effective in the long term.109

There are cases in which the financing tools described in the previous section include gender considerations (Pathway 6). For example, the Asian Development Bank issued 14 gender bonds (for a total of USD 3.6 billion) up to 2023 through its gender thematic bond programme, which mobilizes financing towards projects aimed at narrowing gender disparities and promoting the empowerment of women and girls.112 In Morocco, a private bank (Banque Centrale Populaire) issued a bond of USD 20.4 million to finance women-led projects through microleasing, a sound alternative for increasing women’s access to financial services 113 (see Box 14).

Indigenous Peoples face limited access to financial services not only in LICs and MICs but also in HICs like Australia and Canada. Indigenous Peoples often live in remote rural areas and possess no or little collateral, leading financial institutions to perceive that the challenges of providing services to these communities may outweigh the benefits.115–117

Despite the wide recognition that Indigenous Peoples are indispensable partners for reaching the targets of the Paris Agreement, the Global Biodiversity Framework and the 2030 Agenda for Sustainable Development, the corresponding funding strategies do not necessarily reflect their crucial role. It is estimated that most funds targeting Indigenous Peoples and local communities are channelled through indirect funding modalities. For example, only 7 percent of funds disbursed under the USD 1.7 billion COP26 pledge to advance tenure rights and forest guardianship of Indigenous Peoples and local communities went directly to their organizations.118 Thus, the ongoing global discussion on improving direct financing to Indigenous Peoples for their self-driven development remains paramount (see Box 15).

BOX 15The Indigenous Peoples Assistance Facility

The Indigenous Peoples Assistance Facility (IPAF) is an innovative funding instrument that Indigenous Peoples’ communities can use to find solutions to the challenges they face. It finances small projects that foster the implementation of self-driven development projects based on the demand expressed by Indigenous Peoples themselves.119 Several IPAF-funded projects have enabled Indigenous Peoples’ communities to improve their food security and nutrition and strengthen their agrifood systems by promoting sustainable food production, traditional agricultural systems and techniques, and by reviving Indigenous Peoples’ knowledge. Projects have addressed food security with a holistic perspective while also trying to protect biodiversity, natural resources, traditional cultures and Indigenous Peoples’ rights. For example, through an IPAF project implemented in Argentina (2018–2021),120 the Mapuche Cayún community was supported to improve food security at community level. In addition to generating a surplus to be sold to the market and reinforcing economic links with other Mapuche communities, the project helped promote the importance of diet diversification, traditional cuisine and medicinal herbs in the communities (Pathway 6).

Another project implemented in the Plurinational State of Bolivia121 aimed to address the negative effects of El Niño and La Niña, which have caused considerable economic losses for Guaraní Indigenous farmers due to droughts and frosts in the municipality of Yacuiba. The project focused on improving agricultural practices through the revival of traditional knowledge and participatory learning practices such as Farmer Field Schools. It covered a wide range of activities such as training on traditional production techniques and organic farming, irrigation techniques, natural resources management, and nutrition, food security and traditional food and recipes (Pathway 6). As a result, 57 households were able to set up 55 agroecological and three communal gardens. In Colombia, an IPAF project122 specifically focused on the preservation and promotion of potato varieties with great potential to both improve marketing as well as food security and nutrition of Pastos Indigenous communities in the territory of Gran Cumbal. The project conducted research and identified over 36 varieties of native potato and five select varieties with great production potential. Furthermore, it established seed banks and promoted traditional techniques for organic potato production (“shangra”), sowing, cultivation, harvesting and storage in experimental units covering a territory of 15 hectares (Pathways 4 and 6).

These examples show that a key characteristic of IPAF projects for food security and nutrition is their focus on promoting and reviving traditional foods as they provide a variety of nutrients, enhance dietary diversity, and increase the adaptability to climate change. In 2023, 18 new projects worth USD 1.2 million were approved, to be implemented by Indigenous Peoples’ communities and their support organizations in 13 countries in Latin America and the Caribbean.

Access to financing by agrifood value chain actors is very different depending on their characteristics. While large commercial agricultural producers have relatively easy access to loans and capital, smallholder farmers and agrifood SMEs face many challenges in accessing financing due to their lack of collateral, a financial track record or even a bank account.81 The lack of access to financial services can also diminish the potential contribution of smallholder farmers and agrifood SMEs to achieving food security and improving nutrition, for instance, by limiting their capacities to offer safe and nutritious foods (see Box 16).123

BOX 16Innovative social impact investment fund in Uganda

The Yield Uganda Investment Fund was established in 2017 by the European Commission through the National Social Security Fund. It was set up as a Ugandan company partly to support financial sector development. Most similar funds are registered in countries like Mauritius, which brings clear advantages to the investors in terms of smooth transfer of funds, taxation and the resolution of potential disputes.

The fund invests in companies that offer social impact with financial returns. A business development facility improves the companies’ operational processes and addresses environmental and social impact and governance. To date, the fund has made 13 investments in Uganda worth over EUR 12.9 million.

Experience has confirmed the findings of the initial market study done by the European Commission that many agrifood small and medium enterprises (SMEs) in Uganda are constrained by a lack of adequate capital to fuel their growth.124 Financial institutions’ terms are too expensive, require a lot of collateral or have repayment schedules not in line with the company’s business plan. It is essential to the business ecosystem that small agribusinesses access this capital in order to grow, creating demand for smallholder farmers’ produce, which will in turn provide more opportunities in their communities and drive sustainable rural transformation.

Having a Uganda-based fund manager is a major advantage in different ways. First, a local presence and informal networks in the sectors allows the fund to identify risks associated with the investments that would have been extremely difficult to discern otherwise. Their proximity to the SMEs allows them to build a closer partnership with the promoters who get to benefit from continuous capacity support from the fund manager.

Agricultural technical assistance plays an important role in mitigating risk and boosting confidence for financial institutions involved in smallholder financing. It ensures that other constraints hindering the growth of SMEs are addressed to create the right enabling environment. Technical assistance linked to investment vehicles is ideal, providing more flexibility for companies and supporting pipeline development effort for the funds. For the Yield Uganda Investment Fund, this cost-sharing facility is helping companies tackle environmental, social and governance gaps, build or extend their smallholder farmer networks, obtain important certifications, and improve their operational efficiencies.

Agrifood SMEs are critical for rural economies.125 They are often value chain actors that create opportunities and benefits for smallholder farmers through sourcing, processing, packaging, transporting and selling food to consumers.126 Despite the vital role of these SMEs in agrifood systems, they are often underserved, as investors are reluctant to finance local market producers in local currency as they wish to avoid risks associated with exchange rates, and prefer to serve more export-oriented SMEs. Local lenders need to fill this gap but are hesitant to participate in these markets due to the high risk. Small lenders, such as microfinance institutions, often provide too little financing, while commercial lenders may find it too risky to lend to agrifood SMEs.127 Providing access to appropriate financing and complementary investments enables agrifood SMEs to offer economic opportunities in rural and urban areas alike. Through backward and forward linkages, the multiplier effects of these agrifood SMEs can support the achievement of SDG Targets 2.1 and 2.2, as well as the overall rural transformation objectives.

For instance, in Cambodia, the Accelerating Inclusive Markets for Smallholders project develops and promotes linkages among small-scale producers, off-takers and service providers.128 It develops a value chain innovation fund, which will provide direct financial support to stimulate private investment in high-value agriculture. Also, the project organizes multistakeholder platform events and offers business literacy training (Pathway 3). As at December 2023, the project had supported more than 78 000 households across more than 1 900 producer organizations. In addition, more than 3 000 multistakeholder platform events had been organized, and a credit line of more than USD 6 million disbursed to agricultural cooperatives, SMEs and agribusinesses.129 In Uzbekistan, the Dairy Value Chains Development Project was co-financed by the Government of Uzbekistan, domestic financial institutions and project participants. It promoted development of dairy value chains by increasing productivity, competitiveness, income, and market access to small-scale producers and commercial dairy farms. It offered capacity building, training and financial support in the form of credit lines to dairy processing enterprises for production and processing activities (food availability and Pathway 3). Findings from the project’s impact assessment show that credit provided by the project increased recipients’ total income by 36 percent. More specifically, credit led to an 84 percent increase in livestock income, a 55 percent increase in crop income and a 27 percent increase in agricultural wage income.130 Among those who received the credit, milk sales increased by 41 percent, and the share of milk sales in total production was 13 percent higher. Food security was found to be 26 percent higher in households that received the credit compared to households that did not.

In addition, for both smallholder farmers and agrifood SMEs, supply chain innovations can be adopted to reduce the barriers to access financing flows in a timely manner. For instance, contractual arrangements between agrifood supply chain actors can enable suppliers to access transaction funds faster and under favourable terms. One example of this is long-term contracts signed between the dairy industry and producers in Northern America and Europe, which involve price agreements that stabilize producers’ profits and allow them to access credits and other financial tools.131 Warehouse receipts are another instrument that, even though not new, have not yet been fully adopted by smallholder farmers. These receipts allow farmers to store their production surplus and sell it later, when prices are higher, and use it as collateral for accessing credit. However, the cost involved could be high and/or the crops targeted may not be the most adequate for implementing this instrument. Increasing price premium and/or lowering the cost of storage in warehouses should be considered for making this instrument attractive in LICs and MICs.132 Invoice discounting is a mechanism for suppliers to instantly obtain the value of their invoice, thereby replenishing working capital for further operational arrangements. Smallholder farmers often sell through cooperatives and aggregators, who likewise fall short of working capital to pay the farmers immediately. To remedy this, in India, for example, Mastercard works with M1xchange, an entity that facilitates discounting and the sale of receivables to banks and non-banking financial companies, bringing on board a wide range of lenders for agrifood SMEs to better access credit and working capital (food availability). By leveraging digital platforms, farmers and cooperatives within this initiative have access to both buyer and lender, thereby increasing the business velocity both ways and being paid instantly.133

For several countries, remittances can be a significant component of financing flows for food security and nutrition, but a low share is invested in agrifood systems, while the lion’s share supports food consumption (see Chapter 4). Most of the time these resources are received by low-income households in LICs and MICs, and evidence has shown that they could improve the food security and nutrition of the recipient households.aw

Bringing remittances to the formal financial system can increase its impact at the household and community levels. As shown in Chapter 4, cross-border remittances have grown every year except 2020, and nearly half of the flows sent between 2017 and 2022 were allocated to uses that likely contributed to food security and nutrition, such as food consumption, but much less was destined for investment in agrifood systems. For instance, the Platform for Remittances, Investments and Migrants’ Entrepreneurship in Africa (PRIME Africa) supports the reduction of transaction costs of remittances and the inclusion of the recipients in the financial system.136 In an effort to connect the largest economies in Africa – i.e. the East and the West – Access Holding, the parent holding company of one of the major banks on the continent, announced a partnership with key telecommunication operators, financial services providers and mobile money/digital payment operators to enable remittance across this East–West corridor (Pathways 3 and 6). Such an initiative will reach 60 million customers and 5 million businesses across more than 20 countries on the continent. In 2023, remittances to Nigeria accounted for 38 percent of the USD 58 billion remittance flows to the region, growing by 2 percent, while Ghana and Kenya posted estimated gains of 5.6 percent and 3.8 percent, respectively. In Tajikistan, an FAO pilot implemented a cash-matching grant scheme, which matched every US dollar of every remittance that beneficiaries invested in agribusinesses. Implemented jointly with technical assistance, the pilot allowed beneficiaries to scale up agribusiness investments and employment generation.137 And yet, the remittance effect regarding improving food security and nutrition is mixed: Remittances contribute to improved consumption patterns, the average value of food products, and the accessibility of dietary energy supply, but their influence on nutritional quality and dietary diversity remains inconclusive.138 Nevertheless, remittance inflows support access to essential food items, particularly during periods of escalating food prices.139, 140