- ➔ Finding innovative, more inclusive and equitable solutions to scale up financing for food security and nutrition in countries with high levels of hunger, food insecurity and/or malnutrition and important constraints in accessing affordable financing flows, is urgently needed. Only a minority (37 percent) of 119 low- and middle-income countries have many financing options.

- ➔ The prevalence of undernourishment and that of stunting in children below five years of age tend to be much higher in countries with limited ability to access financing. Countries with more ability to access financing exhibit a higher prevalence of overweight in children below five years of age.

- ➔ Countries with limited access to financing are generally affected by one or more major drivers of food insecurity and malnutrition, particularly climate extremes but also conflict, which opens up opportunities for leveraging climate and humanitarian finance activities for financing food security and nutrition. For these countries, grants or concessional loans remain the most suitable option to scale up financing for food security and nutrition and can be leveraged through collaborative financing partnerships as part of blended finance strategies.

- ➔ Countries with moderate ability to access financing can rely more heavily on domestic tax revenues due to their wider tax base and stronger public institutions. Their governments can raise revenues by steeping up health taxes to promote the consumption of healthy diets.

- ➔ Countries with a high ability to access financing can take advantage of increasingly promising financing instruments such as green, social, sustainability and sustainability-linked bonds, which may also embed food security and nutrition objectives.

- ➔ Making innovative financing instruments more accessible to population groups facing constraints in accessing financial services, such as women, Indigenous Peoples, smallholder farmers and small and medium agrifood enterprises, will be key for financing to work for food security and nutrition.

- ➔ The current financing architecture for food security and nutrition is highly fragmented. Country donors, multilateral development banks, development finance institutions, international financial institutions and philanthropic foundations have risen in number, but this has created coordination challenges, not only for these actors, but also for recipient countries whose political and financial priorities are not always considered.

- ➔ Commercial private actors consider food security and nutrition a risky area to invest in, and the lack of data and transparency in the financial sector does not facilitate the creation of an “investment case” for meeting SDG Targets 2.1 and 2.2.

- ➔ The financing architecture for food security and nutrition needs to shift from a siloed approach towards a more holistic perspective whereby stakeholders consider food security and nutrition to be a single policy goal that is featured in their broader financing flows and investments.

- ➔ Policy priorities of national and local actors must be considered while building this new narrative for an enhanced financing architecture for food security and nutrition. Multilateral development banks, development finance institutions and international financial institutions should take the lead in scaling up financing for food security and nutrition, increase their risk tolerance and be more involved in de-risking activities.

- ➔ The public sector should fill gaps not addressed by commercially oriented actors, primarily by investing in public goods and enhancing social values, which requires relying on tax revenues, reducing corruption and tax evasion, stepping up food security and nutrition expenditure, and repurposing policy support.

- ➔ Improving transparency is essential for enhancing coordination and efficiency among the different stakeholders and will require harmonizing data collection standards at the national and global levels and making data available, which, in turn, is critical to target financing towards the countries most affected by food insecurity and malnutrition and their drivers.

5.1 Scaling up financing flows to food security and nutrition

What are the levels of ability to access financing for food security and nutrition and what determines a country’s level?

The determinants of access to financing at national level

The spread and severity of how the major drivers of food insecurity and malnutrition are affecting the world is alarming (Chapter 3). At the same time, the ever-widening gap between current financing and the financing needed to meet SDG Targets 2.1 and 2.2 (Chapter 4) renders the challenge even more urgent: How can all financing for food security and nutrition stakeholders scale up financing for the countries most affected by food insecurity and malnutrition, which also are those most affected by multiple major drivers concurrently?

One of the most important variables that determines countries’ ability to access financing is national income. Naturally, low- and middle-income countries (LICs and MICs) face more barriers than high-income countries (HICs) do in accessing financing flows, as national income is an indicator of a country’s capacity to pay back debts. For instance, the World Bank uses per capita income as a main indicator to establish whether countries are part of the International Development Association (IDA), the branch of the World Bank that provides concessional finance to the poorest countries,1, 2 while the focus of the financing flows mobilized by the United Nations Capital Development Fund is on the world’s least developed countries (LDCs).y, 4

In addition to national income, a country’s level of debt is without doubt a key assessment variable. Countries that are highly indebted are unlikely to receive more resources from external sources, and certainly not from private stakeholders (banking systems, capital markets, and so on), but nor do they receive non-concessional financing inflows from other stakeholders such as development finance institutions (DFIs) or international financial institutions (IFIs).z For instance, the World Bank and the International Monetary Fund (IMF) assess countries’ debt sustainability to make decisions on the allocation of concessional finance for LICs and lower-middle-income countries (LMICs) in the form of grants or loans.5

Unsustainable levels of debt, especially when interest rates are high, limit the much-needed public investments for LICs and MICs in sectors that are key for development; such limitations likewise create uncertainty that can undermine economic growth.6 Debt service levels are increasingly burdensome for debtor countries and can restrict public spending options. For instance, Africa’s external debt service has been increasing, and projections show it can reach a peak of USD 74 billion in 2024.7 While not all countries at risk of debt distress are necessarily facing a high prevalence of undernourishment and food insecurity and multiple burdens of malnutrition, when these issues are faced concurrently the situation can become even worse: In some cases, a country’s debt default can lead to economic downturns and rising food prices, which can certainly increase the risk of becoming food insecure and/or malnourished.8

In addition, governance quality can affect a country’s ability to access financing. Even in contexts of high debt and/or low-income levels, the capacity and effectiveness of national institutions, rule of law, accountability and transparency, and the quality of regulations may influence the outcome of financing decisions. In fact, financial institutions such as the World Bank and the IMF already consider governance quality in their country assessments.aa Governance is also a key factor in addressing the major drivers of food insecurity and malnutrition and can accelerate the building of resilience to these drivers through the implementation of sound policies, investments and legislation;10 it is widely recognized as an essential condition for scaling up different financing flows such as domestic revenues11 or foreign direct investments,12 and it is even considered an important factor for achieving an adequate national food supply.13 Therefore, strengthening national governance and institutions is essential – not only to increase countries’ ability to access financing, but also to enable them to use financial resources effectively to achieve food security and end all forms of malnutrition.

Finally, the level of digitalization is increasingly considered relevant for improving access to financing,14 and studies have shown that countries’ investments in digitalization can boost economic growth, employment and governance quality.15 Digitalization also supports enhanced levels of traceability of financing flows, which could lead to higher levels of transparency and increased trust among financial stakeholders, thereby improving countries’ ability to access financing. Especially in situations where other determinants of countries’ ability to access financing still need to be improved, high digitalization levels can facilitate a financial stakeholder’s decision to invest.

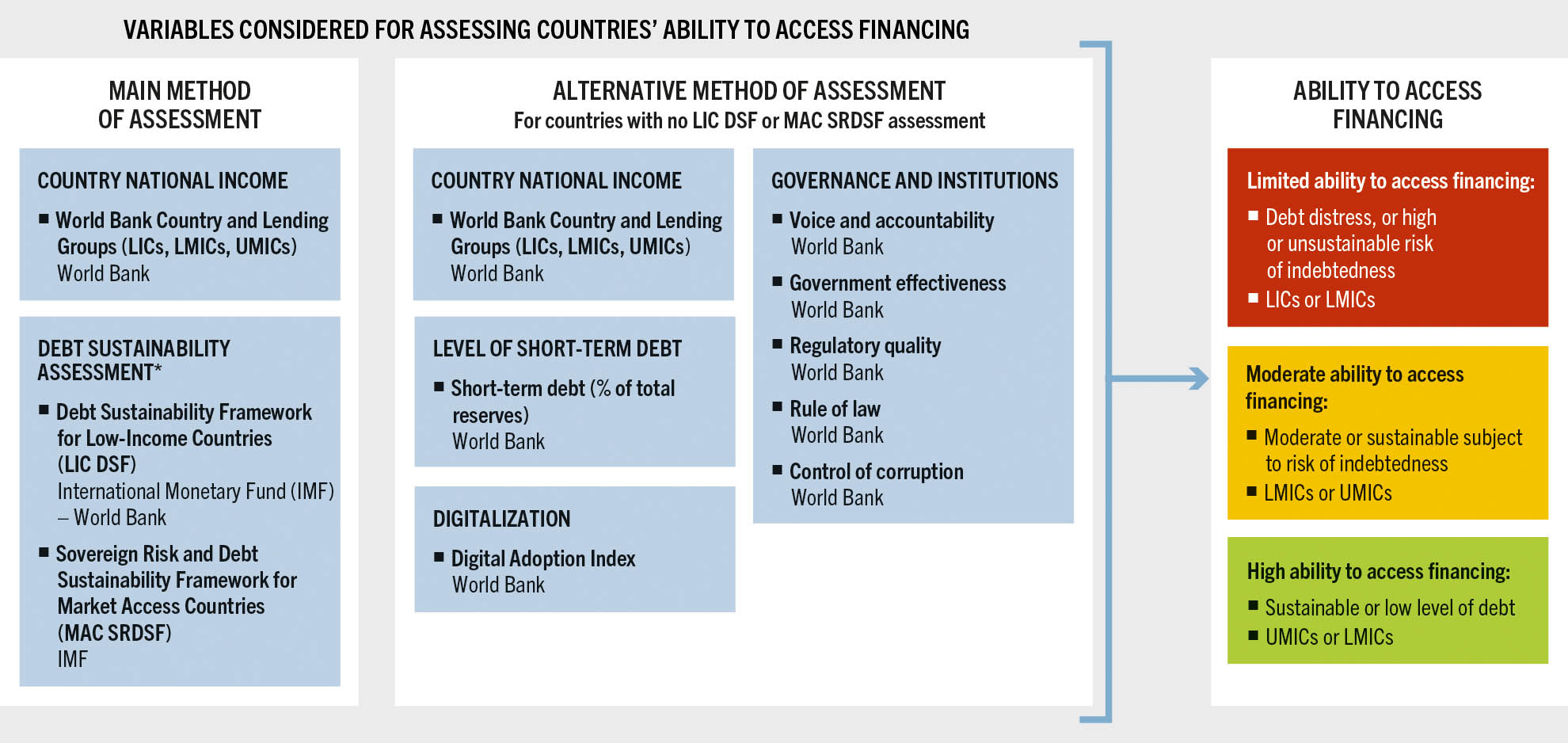

The operationalization of these variables to create three groups, assessing countries’ ability to access financing, is presented in Figure 30. Three indicators were identified for the four variables discussed above: i) the World Bank’s country and lending groups; ii) the World Bank and IMF’s Debt Sustainability Framework for Low-Income Countries (LIC DSF); and iii) the Sovereign Risk and Debt Sustainability Framework for Market Access Countries (MAC SRDSF). For countries not assessed by either LIC DSF or MAC SRDSF, in addition to the World Bank’s country and lending groups, the short-term debt as a percentage of total reserves is used for the debt levels; five out of six of the World Bank’s Worldwide Governance Indicatorsab are used for governance quality; and the World Bank’s Digital Adoption Index (DAI) is used for digitalization.ac

FIGURE 30 Summary of the methodology for assessing countries’ ability to access financing

SOURCE: Authors' (FAO) own elaboration.

Do countries with high levels of hunger, food insecurity, childhood stunting and childhood overweight, including those affected by the major drivers, have the ability to access financing for food security and nutrition?

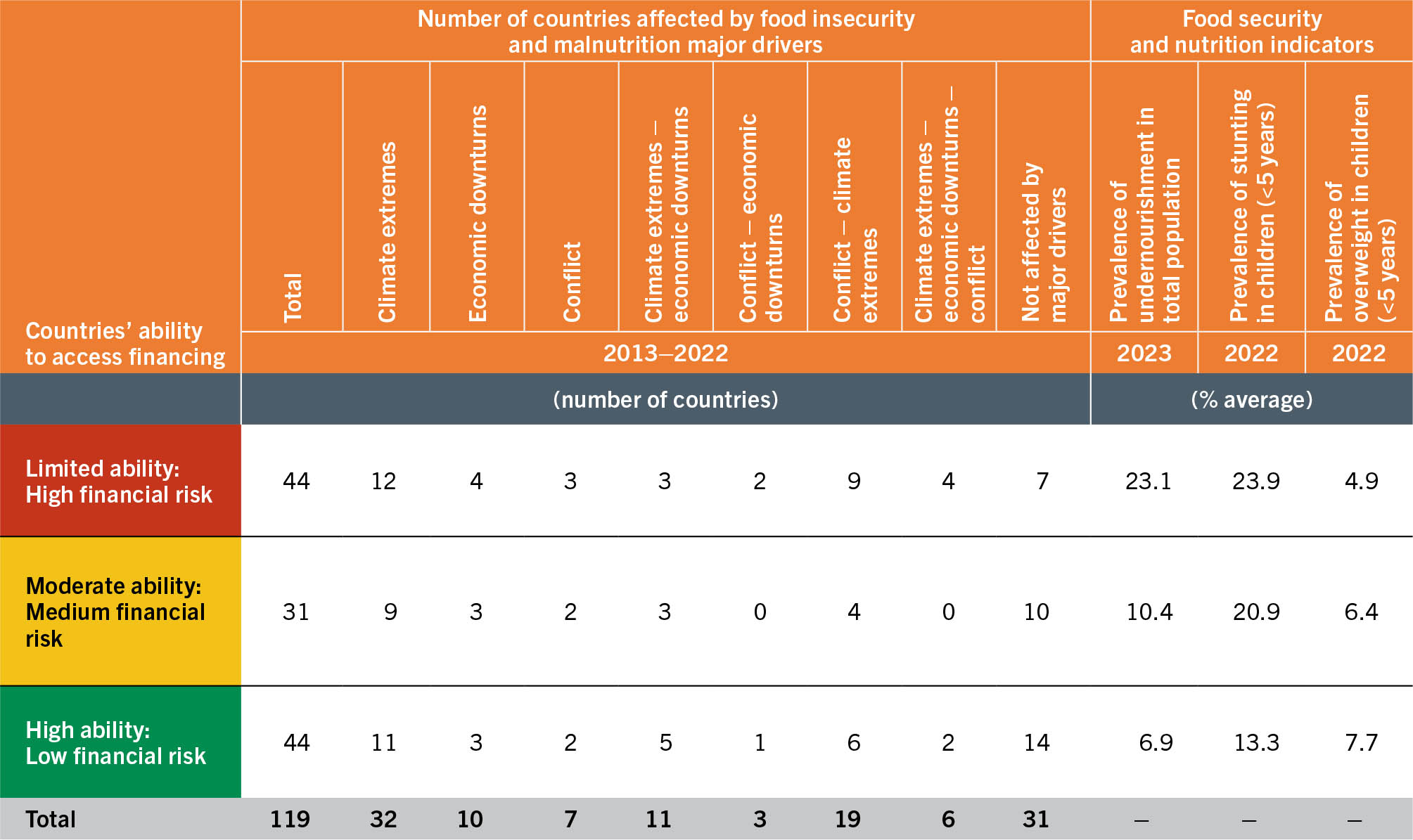

The results of applying the methodology outlined in Figure 30, jointly with data of food security and nutrition indicators and of countries affected by the major drivers of food insecurity and malnutrition, are shown in Table 18.ad

TABLE 18Low- and middle-income countries’ degree of ability to access financing, considering food security and nutrition indicators and the major drivers

SOURCE: Authors' (FAO) own elaboration.

Table 18 shows the urgency to find innovative solutions to scale up financing for food security and nutrition in LICs and MICs. Sixty-three percent of these countries have limited or moderate ability to access financing,ae while the minority (37 percent) have high ability. The prevalence of undernourishment (PoU) is, on average, much higher in countries with limited ability to access financing (23.1 percent) than in countries with moderate and high ability to access financing (10.4 percent and 6.9 percent, respectively). A similar trend is observed for the prevalence of stunting in children below five years of age, although the average prevalence of stunting in countries with limited and moderate ability to access financing (23.9 percent and 20.9 percent, respectively) is much closer than the average PoU. These results are aligned with the findings of Chapter 4, which found a negative association between general domestic government expenditure on agriculture and PoU and stunting. As discussed in the next section, countries with limited ability to access financing have lower possibilities of increasing public spending, and therefore, their current spending levels are probably low. Similarly, the average of overweight in children below five years of age follows the same pattern as the findings in Chapter 4: The higher the ability to access financing (or the general domestic expenditure in agriculture), the higher the levels of childhood overweight.

On the other hand, 74 percent of all countries analysed are affected by one or multiple major drivers, and 66 percent of these countries have limited or moderate ability to access financing (most of them limited, 42 percent). Among countries affected by major drivers, climate extremes are the most prevalent driver at all levels – limited (75 percent, alone or in combination with other drivers), moderate (76 percent) or high (80 percent) ability to access financing – which is expected considering that climate extremes are the most common driver, as analysed in Chapter 3. For countries with moderate or high ability, there is no difference between conflict and economic downturns: 28 percent of countries with moderate ability to access financing are affected by conflict or by economic downturns, alone or in combination, and for countries with high ability, this proportion increases to 36 percent. However, for countries with limited ability to access financing, more are affected by conflict (48 percent) than by economic slowdowns (35 percent). In fact, as observed in Table 18, across all categories of financial access, and for all combinations of drivers, conflict affects more countries with limited access to financing than countries with moderate or high financing options.

The high proportion of countries affected by at least one major driver builds the case for mainstreaming food security and nutrition objectives across other sector financing where the priorities do not always include meeting SDG Targets 2.1 and 2.2. Considering that climate extremes are the most prevalent driver in all country groups, the opportunity of creating synergies between food security and nutrition and climate objectives will be essential for scaling up enough resources to fill the funding gap. On the other hand, the relevance of conflict as a driver in countries with limited access to financing calls for strengthening the humanitarian–development–peace nexus, as well as for bridging the short-term horizon of humanitarian operations with the needed long-term perspective of investments oriented to eradicating hunger, food insecurity and malnutrition. In addition, the higher PoU and stunting levels found in countries with limited or moderate access to financing emphasize the urgency of scaling up financing flows for ending hunger, food insecurity and malnutrition. This, together with the higher prevalence of children’s overweight in countries with high ability to access financing, opens the window for innovative financing instruments that may consider objectives related to SDG Targets 2.1 and 2.2 in their design and implementation.

Nevertheless, the opportunity to create such synergies and seize those opportunities is challenged by the conditions limiting the access to financing in most of these countries. As mentioned above, most of the countries analysed are facing the double challenge of eradicating hunger, food insecurity and malnutrition, as well as building resilience to the three major drivers, in adverse financial conditions, because they have limited or moderate ability to access financing. How do these conditions affect the risk perception among financial stakeholders, and what alternatives do these countries have to effectively increase their financing options for meeting SDG Targets 2.1 and 2.2?

Which are the available and most affordable financing tools, depending on a country’s ability to access financing, to fill the financing gap for meeting SDG Targets 2.1 and 2.2?

Scaling up financing flows towards countries with the highest levels of hunger, food insecurity and malnutrition and/or those most affected by the major drivers is essential. For example, considering only official development assistance (ODA), Asia and Africa have received most of the ODA for agriculture in recent years,af which is to be expected since most of the hungry and food insecure live in these regions. In terms of budgetary needs from external donors, high-priority countries (i.e. countries with more than 50 percent of their budget dependent on donors) are all located in Africa.17 In addition, the increased financing should be consistent with the global roadmap for achieving SDG 2 without breaching the 1.5 °C threshold,18 to ensure that there is access to sufficient, nutritious foods for all today and tomorrow.ag

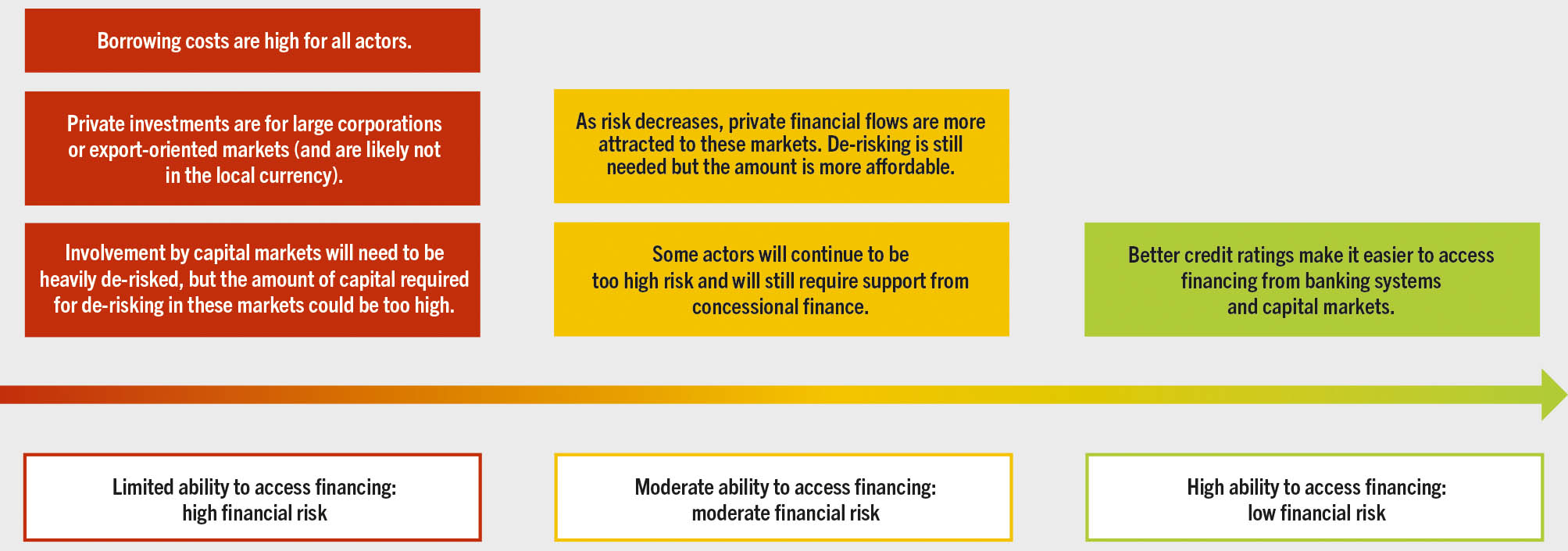

However, in most cases, countries that are the most in need, in terms of both hunger and food insecurity levels, as well as in terms of how they are affected by the major drivers, are facing structural limitations to increase financing for food security and nutrition, as shown in Table 18. Even if, formally speaking, all countries have access to most of the existing options for financing, their ability to access financing is driven by levels of perceived financial risk and the associated costs (see Figure 31). The obvious risk aversion of all financial stakeholders, especially in the case of private, commercially oriented ones, renders their engagement practically impossible in the most financially risky countries.

FIGURE 31 Risk gradient for financial stakeholders

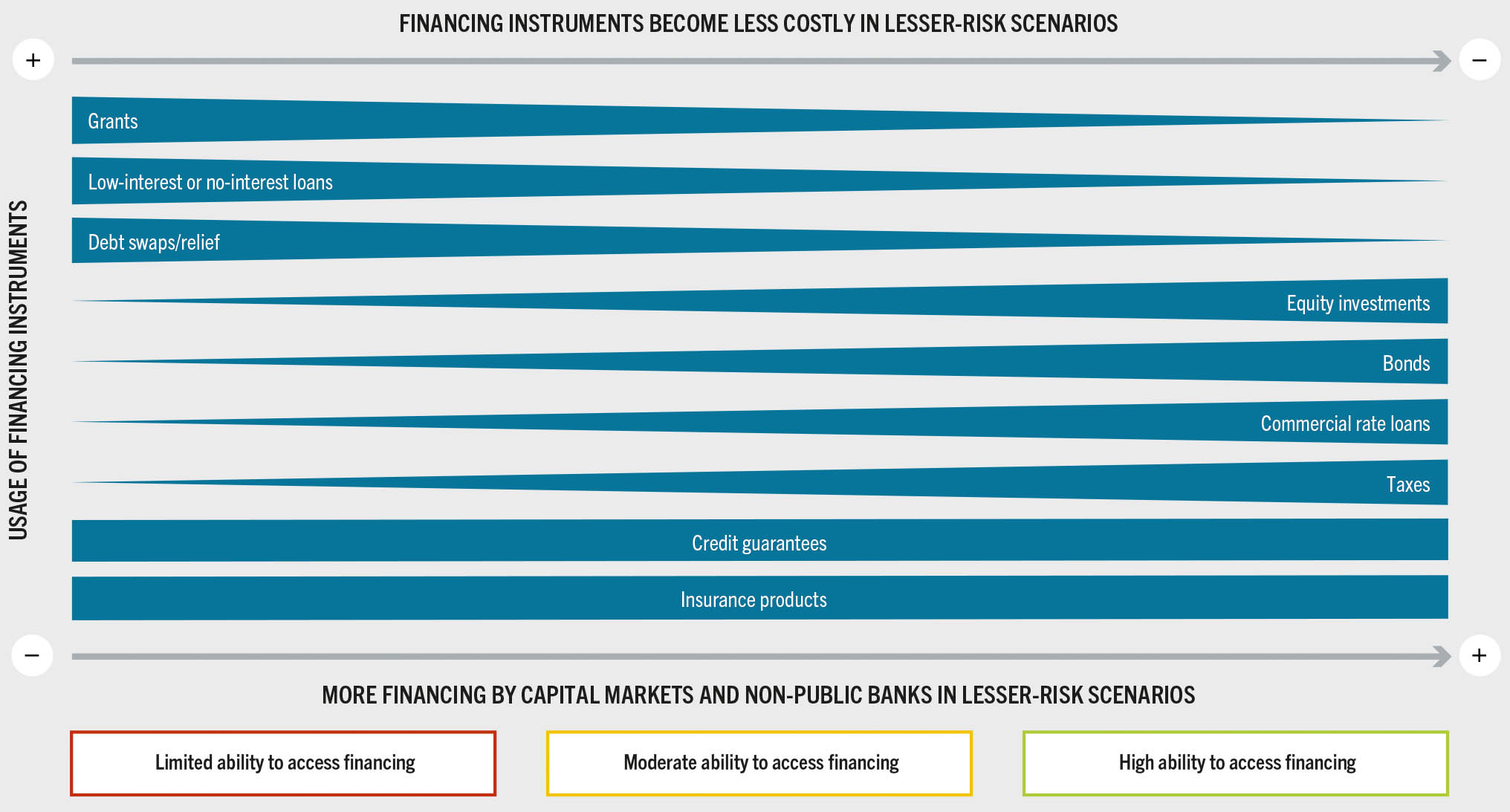

When the confidence in countries’ ability to repay loans decreases (thus, a higher financial risk), the affordability of financing flows is reduced.ah Therefore, countries with limited ability to access financing may rely only on grants or low- to no-interest loans from international development flows (e.g. ODA), as other financing instruments may not be available – or, more precisely, financial stakeholders may not be interested due to a country’s high financial risk profile (see Figure 31 and Figure 32). The involvement of private, commercially oriented actors in these countries is unlikely as risks are high, affecting, for instance, the cost of borrowing. Only large corporations and/or export-oriented actors have a higher likelihood of being financed by private flows, and even in these cases, these entities may be considered risky investments. In addition, the low tax base of many of these countries – due, inter alia, to structural factors, with a predominantly informal environment not conducive to tax collection, and to governance weakness – makes public investment with domestic resources difficult.11

FIGURE 32 Which are the most adequate financing tools and mechanisms depending on the country context?

The high dependence on concessional finance for countries with limited ability to access financing could lead to the consideration of some possible trade-offs. For example, some scholars have studied the possibility that scaling up concessional finance (e.g. grants and no-interest loans) could cause “Dutch disease”,ai highlighting the need to create capacities in national governments to absorb and spend these resources, particularly on public investments and capital goods.22 Likewise, the orientation of concessional finance itself matters for meeting SDG Targets 2.1 and 2.2. It has been observed, in a sample of 95 LICs and MICs, that an increase of 10 percent in certain categories of ODA related to food security and nutritionaj can reduce hunger by 1.1 percent, on average two years after the financing flow is disbursed.23

The high reliance on concessional finance can also affect the trends of other sources of financing. For instance, one study found a negative association between ODA grants and tax revenues, particularly in LICs.24 Another25 showed that some grants from international development flows include conditionalities such as increases in tax revenues over time and reductions in external debt through borrowing. However, as indicated above, countries with limited ability to access financing in most cases are not able to increase tax revenues. Therefore, a country’s reduction in borrowing and the inability to increase tax revenues can lead to fewer available resources and, in turn, place a lower-than-expected expenditure on the sector to which the grant was directed.

Countries with limited ability to access financing have high levels of sovereign debt and must spend significant amounts of public revenue on servicing debt. For these countries, debt swaps and debt relief measures can allow the reallocation of resources towards food security and nutrition.ak

In sum, in countries with limited ability to access financing, the role of donors and other development institutions in delivering international development flows is essential to fill the financing gap for meeting SDG Targets 2.1 and 2.2. In countries with moderate ability to access financing, utilizing concessional finance and commerce-oriented instruments following a blended finance approachal will still be essential for de-risking investments and providing the right incentives for private actors to participate in these markets. However, while moving towards lower levels of risk, it is expected that public and private actors can progressively increase their engagement, making more financing flows available (i.e. more affordable).

Mobilizing domestic tax revenues is more feasible in countries with moderate ability to access financing (see Figure 32). Deepening the tax base could reduce some countries’ dependence on concessional finance (or commercial loans and debt), and in several countries, there is the potential to increase tax revenues from their current levels.26 However, as mentioned, the potential expansion of tax revenues has income as a strong determinant (the higher the GDP per capita, the higher the tax potential), as well as other factors such as the composition and formalization of national economies, and institutional and governance mechanisms.am Some scholars have studied countries’ “tax effort” (the ratio of actual tax collection to tax potential) to analyse whether there is space to improve mobilization of domestic resources. While the numbers vary, there is agreement on the potential for expanding revenues globally, and such potential is greater in LMICs and upper-middle-income countries (UMICs) than in LICs.26, 28

As financial risk decreases, more financing flows are available for countries. Countries with a high ability to access financing will draw in equity investments, commercial rate loans and bonds from private financing flows such as company investments, banking systems and capital markets, with many fewer de-risking activities needed from donors or the public sector (Figure 31 and Figure 32). However, as analysed in detail in Section 5.2, even in these countries, access to guarantees and insurance is still essential for de-risking private financing flows. While the way in which guarantees or insurance are delivered varies depending on a country’s ability to access financing, these instruments are essential for scaling up financing in the three categories of countries. Therefore, these instruments are recommended for all country groups in Figure 32.

Scaling up private financing is essential for meeting SDG Targets 2.1 and 2.2 because of its well-known role in overall economic development, and for the simple reason that funding from other financing flows like international development flows or public budgets is not sufficient to fill the financing gap to end hunger, food insecurity and malnutrition. For instance, foreign direct investment (FDI) has an important role for LICs and MICs, but its effects may vary depending on a country’s income level and the sector of the FDI. For example, agriculture and industry FDI have a significant impact on GDP growth in LICs, while FDI oriented to other sectors (e.g. manufacturing and services) has insignificant effects. On the other hand, all kinds of FDI positively impact GDP growth in HICs.29 Foreign direct investment directed to agriculture has also been shown to increase agricultural production in LICs and MICs, and its effects are higher when these are combined with agricultural ODA.30 Nevertheless, as indicated, LICs have mostly limited ability to access financing, making private financing flows costly and rarely available. How can countries reduce their financial risk to attract other sources of financing?

Figure 32 provides recommendations for financing instruments, depending on a country’s ability to access financing flows, as assessed in Table 18. Private financing flows (e.g. equity investments, bonds and commercial rate loans), as well as public domestic financing (e.g. taxes), are more affordable as countries’ financial risk decreases, making them more suitable options; on the other hand, international development flows and concessional finance (e.g. grants, low-interest loans and debt swaps) are the best alternative in contexts of high financial risk, as other options could be too expensive. While Figure 32 proposes examples of financing instruments that could fit each category and be used to increase a country’s ability to access financing (as analysed in detail in Section 5.2), the most effective way to increase a country’s financial options is undoubtedly to address the determinants of their ability to access financing. Addressing these development challenges can result in win–win solutions; for instance, sound economic and monetary policies that reward savings and deepen capital markets are essential for creating a better environment for private investments. Improving tax systems not only increases the financing flows needed to fill the funding gap, but can also lead, through public expenditure, to gains in economic growth and inequality reduction. The strategic adoption of digital technology can make tax collection easier and lead to enhanced transparency, which is key for building trust in national public administrations.31 Reducing and making sovereign debt levels more manageable is an essential requisite for mobilizing the financing needed to implement urgent food security and nutrition actions, as well as policies to build resilience to the major drivers of food insecurity and malnutrition.8 Therefore, better macroeconomic management for income growth, reducing a country’s sovereign risk and debt, and strengthening national institutions and governance, are essential, not only from a financial perspective, but also from the overall development perspective of the countries most affected by hunger, food insecurity and malnutrition.